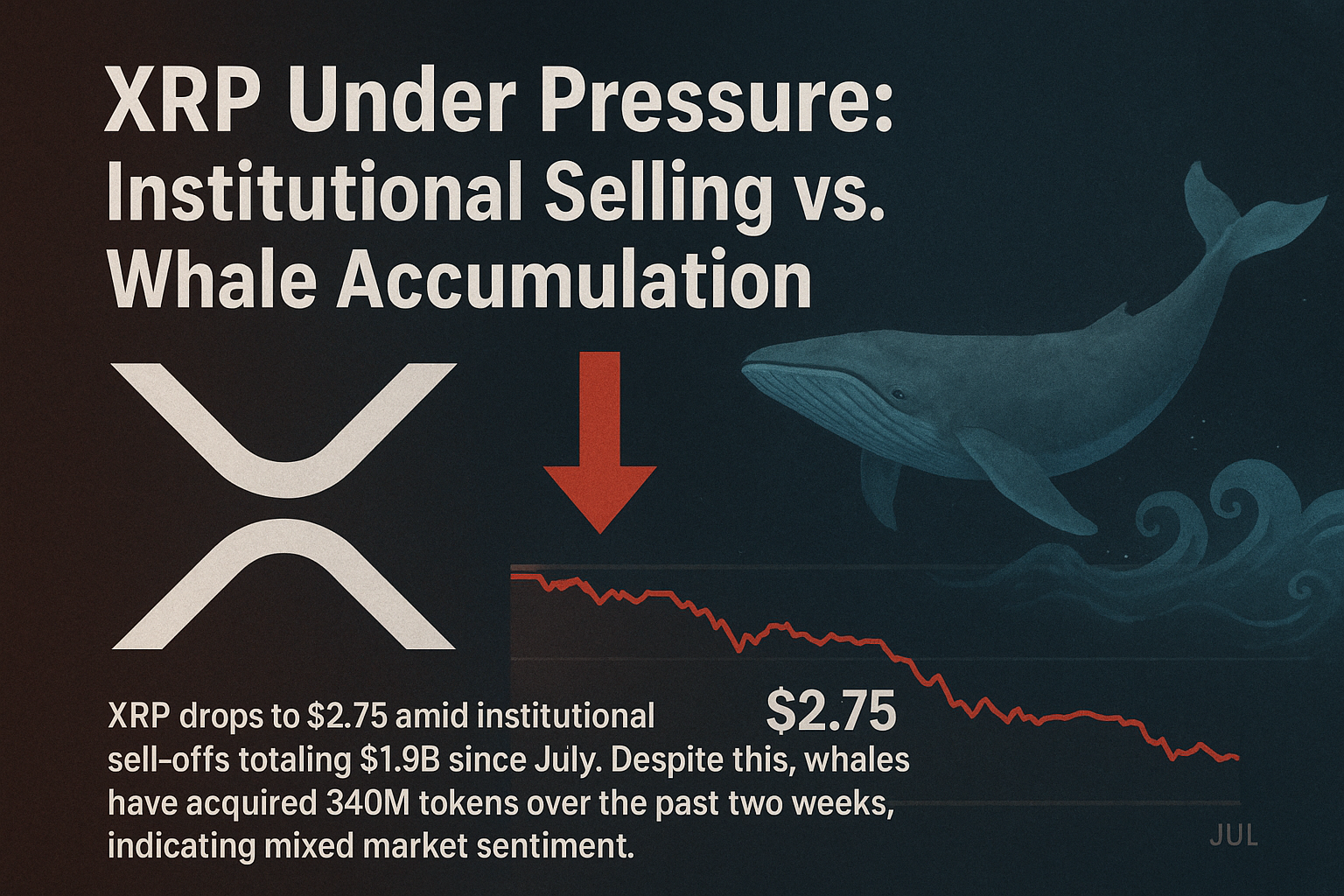

XRP, the digital asset closely associated with Ripple Labs, has come under significant market pressure over the past several weeks. Its price has dropped to $2.75, driven largely by institutional sell-offs amounting to $1.9 billion since July. This wave of distribution signals a shift in sentiment among professional investors and funds, who appear to be taking profits or reducing risk exposure in response to broader market uncertainty.

Institutional Exit: A Red Flag or Just Risk Management?

Institutional investors often act as a barometer for market confidence. Their large-scale sell orders can weigh heavily on price, not only because of the direct supply impact, but also because other market participants often interpret their moves as informed decisions based on in-depth research and risk modeling. The $1.9 billion worth of XRP sold since midsummer suggests that at least some major players see limited short-term upside or are rotating capital into other assets.

Some analysts argue this selling isn’t necessarily a bearish verdict on XRP itself, but rather a reflection of macroeconomic conditions: rising interest rates, tightening liquidity, and shifting regulatory landscapes. In this context, trimming positions in volatile digital assets like XRP may simply be part of a broader risk-off strategy rather than a vote of no confidence in Ripple’s technology or XRP’s long-term potential.

Whale Accumulation: A Contrarian Signal

While institutional exits have dominated headlines, another trend has quietly emerged on-chain: crypto whales—large holders controlling millions of tokens—have accumulated 340 million XRP over the past two weeks. These whales are often long-term participants who buy during periods of weakness, betting that the market is overreacting in the short run.

This divergence in behavior—institutions selling, whales buying—reflects the complex dynamics of today’s crypto market. Unlike traditional finance, where institutional capital overwhelmingly sets the tone, crypto markets are still significantly influenced by individual high-net-worth investors and private funds willing to make bold, contrarian moves.

What Does It Mean for XRP’s Price?

This push and pull between institutional selling pressure and whale accumulation creates uncertainty. If institutional selling continues at the current pace, XRP may face further downward pressure, possibly testing psychological support levels near $2.50 or lower. However, sustained whale buying could gradually absorb selling volume and help stabilize the price.

In addition, Ripple’s ongoing progress in expanding its cross-border payment solutions and forming partnerships could provide fundamental support. If these developments translate into increased XRP utility, market sentiment may turn more positive despite short-term turbulence.

Mixed Sentiment, Elevated Volatility

The current situation highlights how crypto markets can send mixed signals. Institutional flows suggest caution, while whale behavior hints at quiet confidence. For traders and investors, this is a reminder that market sentiment is rarely uniform—and that price action often reflects competing narratives.

Over the next few weeks, analysts will be watching XRP’s trading volumes, on-chain wallet data, and regulatory headlines to see which side gains the upper hand. Whether this period becomes a temporary dip before a rebound, or the start of a longer-term downtrend, will depend on whether accumulation outweighs distribution—and whether confidence returns to the broader crypto market.