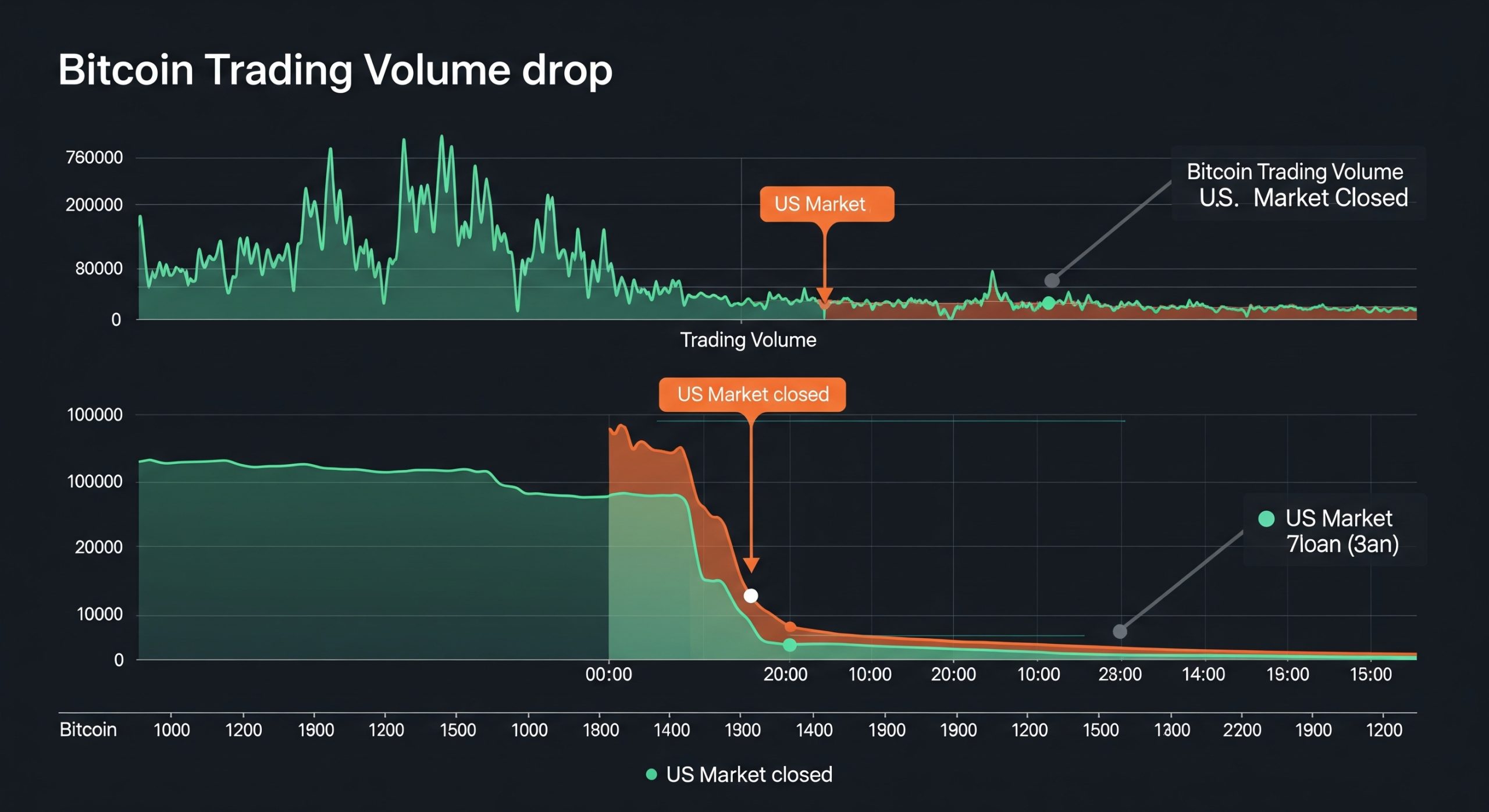

As the United States prepares to celebrate Independence Day, the ripple effects of its market closures are already being felt across the digital asset ecosystem. Bitcoin trading volumes have plunged by 31.84%, highlighting the growing dependence of the crypto market on traditional financial institutions and American investor activity.

The Independence Day Impact

The U.S. financial markets will close early on July 3rd and remain fully closed on July 4th, in observance of the national holiday. While holidays have always brought reduced activity in traditional markets, the knock-on effect on digital assets like Bitcoin and Ethereum is becoming increasingly pronounced. With institutional players and major trading desks based in the U.S., the slowdown in activity from these entities causes a significant liquidity crunch.

Recent data from TronWeekly and AInvest reveals that Bitcoin volumes fell nearly a third in anticipation of the holiday weekend—a stark contrast to the usual 24/7 reputation of crypto markets. Ethereum also saw a similar, though slightly less severe, contraction in trading activity.

Why It Matters

This drop in volume is more than just a temporary lull—it creates an environment ripe for increased volatility. With fewer active traders and lower liquidity, even modest buy or sell orders can cause exaggerated price swings. Retail investors who remain active during this time may find themselves exposed to sudden and unpredictable market moves.

Moreover, reduced trading also tends to coincide with “fakeouts”—brief, deceptive price surges or drops that quickly reverse. Without the usual institutional support to absorb large trades or correct inefficiencies, the market becomes a more precarious place for both newcomers and experienced traders alike.

Institutional Influence on a Decentralized Market

One might wonder: Isn’t the decentralized nature of crypto supposed to make it immune to national holidays and centralized market influences? In theory, yes—but in practice, the crypto market has become deeply intertwined with traditional finance. From Bitcoin ETFs to institutional custody solutions, the presence of Wall Street in crypto is undeniable.

The recent decline in trading activity reflects just how significant that presence has become. When Wall Street takes a day off, so does a large portion of the crypto liquidity pool.

What Traders Should Watch For

If you’re trading crypto this week, here are a few key things to keep in mind:

-

Expect volatility: With fewer market participants, prices may swing more erratically.

-

Avoid large trades: In thin markets, large orders can drastically move prices. Trade cautiously.

-

Be wary of fakeouts: Sharp moves might not have strong support or follow-through.

-

Watch for post-holiday rebounds: Markets may stabilize or even rally once institutional players return.

The July 4th holiday serves as a stark reminder that even the decentralized world of cryptocurrencies is not completely immune to the rhythms of traditional finance. With Bitcoin trading volumes down over 31%, and Ethereum showing similar trends, this week could present both risks and opportunities for savvy traders. Proceed with caution, stay informed, and—if you’re in the U.S.—enjoy the fireworks both in the sky and on the charts.