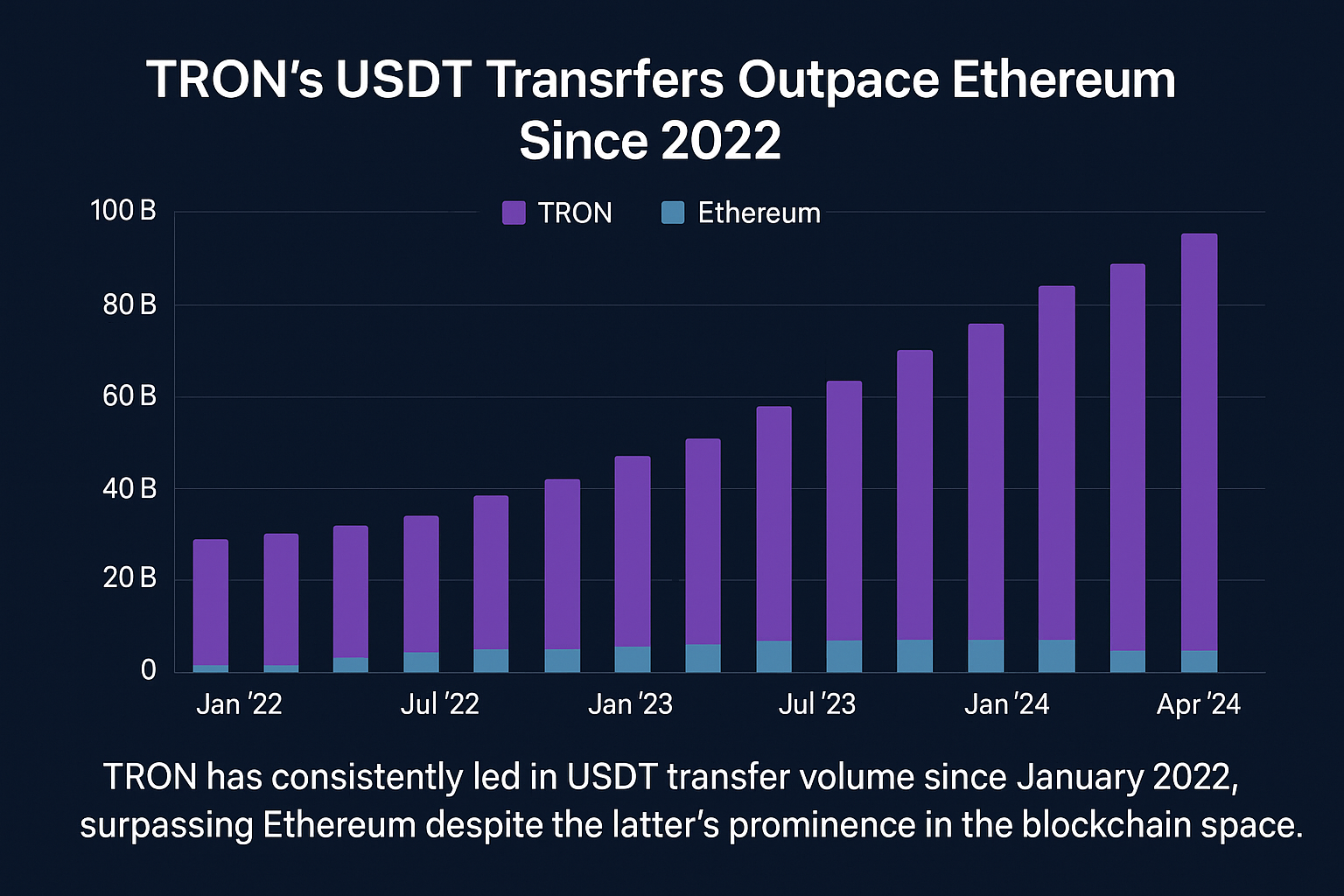

Since early 2022, TRON has quietly but consistently outpaced Ethereum in one of the most significant metrics for stablecoin utility—USDT transfer volume. While Ethereum has long been seen as the standard bearer for decentralized applications and smart contracts, TRON’s low transaction fees and faster processing times have helped it dominate the stablecoin arena.

A Quiet Takeover

The shift began in January 2022, when TRON overtook Ethereum in daily USDT transaction volume. This wasn’t a temporary spike—it marked the beginning of a sustained trend that continues into 2025. Data from Binance and other analytics platforms show that users are increasingly favoring TRON for transferring Tether (USDT), especially in regions with high-volume trading and remittance activity.

One reason for this shift is TRON’s scalability and its nominal fees. With Ethereum gas fees frequently fluctuating due to network congestion and complex smart contract interactions, TRON provides a more predictable and cost-effective environment for stablecoin transfers.

Stablecoin Utility and Global Access

Stablecoins like USDT are crucial for users who want to maintain value without being exposed to crypto volatility. As such, transfer efficiency and low costs are essential. TRON’s architecture caters to this demand perfectly. Its ability to move large volumes of USDT with negligible fees has made it the preferred network for exchanges, DeFi platforms, and everyday users in emerging markets.

In contrast, Ethereum, while still dominant in total DeFi value and NFT volume, has found itself less competitive in this narrow but vital niche.

Institutional Implications

TRON’s dominance is not just a technical detail—it signals a deeper trend in how blockchain utility is being defined. Institutions and developers are beginning to reassess which chains to build on based on specific use cases. If TRON continues to innovate and maintain its edge in transaction speed and cost-efficiency, we could see more integrations and institutional backing.

Moreover, Tether itself has supported TRON’s growth by ensuring smooth issuance and redemption processes on the network, helping to establish TRON as a core part of the global stablecoin infrastructure.

The Road Ahead

Ethereum is far from out of the picture—it continues to evolve with its Layer 2 ecosystem and the upcoming EIP upgrades. However, TRON’s sustained performance in USDT transfer volume shows that blockchain competition is about more than just smart contracts or total value locked. It’s about everyday usability, and in this category, TRON currently leads.

As the blockchain ecosystem matures, expect further specialization among chains. Ethereum may remain the go-to for complex DeFi applications, but for rapid, cost-effective stablecoin transfers, TRON has already taken the lead—and shows no signs of slowing down.