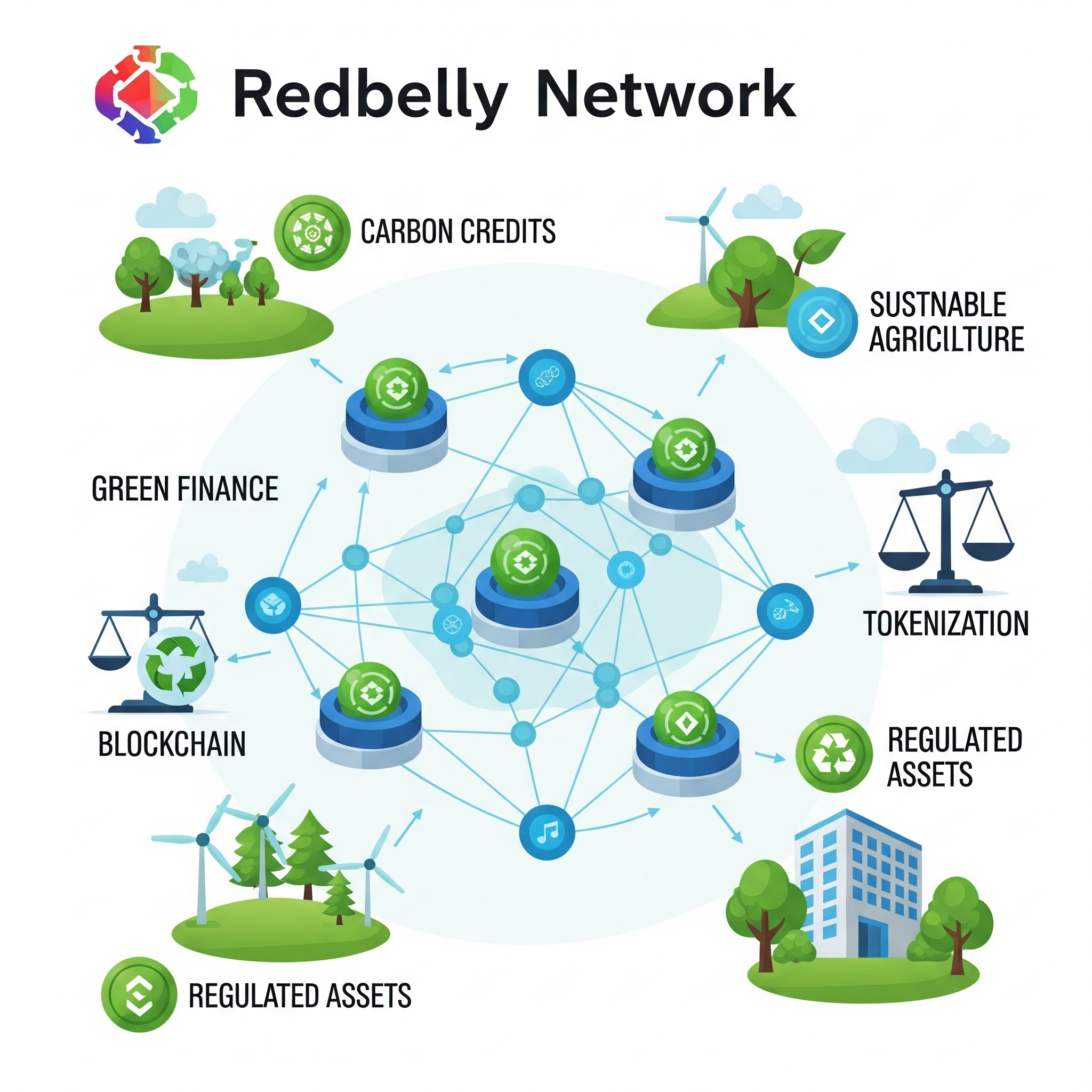

In a landmark move for both blockchain and climate-conscious finance, Redbelly Network has officially launched initiatives to tokenize over $70 billion worth of carbon credits, alongside other major real-world assets like private equity and rental income streams.

This massive tokenization effort represents a significant leap forward in merging decentralized finance (DeFi) with regulated environmental markets, marking the dawn of a new infrastructure for green asset trading on-chain.

The Tokenization Breakthrough

Tokenization refers to the process of converting ownership rights of an asset into a digital token on a blockchain. Redbelly’s approach focuses on high-value, regulatory-compliant real-world assets (RWA) that can now be traded seamlessly, transparently, and securely.

By bringing carbon credits—previously fragmented and opaque—onto a blockchain, Redbelly creates an auditable, tamper-proof ledger of climate-positive actions. In other words, buying and selling carbon offsets becomes as easy and verifiable as trading stocks or crypto.

Why Carbon Credits Matter

Carbon credits are part of global strategies to reduce greenhouse gas emissions. One credit equals one metric ton of CO₂ that has been avoided or removed from the atmosphere.

Yet traditional carbon markets are plagued by double counting, limited transparency, and difficult tracking of credit origins and lifecycles.

Enter Redbelly: using blockchain, the network creates an immutable and traceable record of each carbon credit’s creation, certification, and transaction history—building trust where legacy systems fall short.

Institutional-Grade Compliance

Unlike most DeFi protocols that operate in legal grey zones, Redbelly works within a regulated framework. It focuses on regulated token offerings compliant with financial authorities, allowing institutions to engage confidently.

This opens the floodgates for banks, ESG funds, sovereign wealth managers, and pension institutions to get involved in carbon markets without exposure to unregulated volatility.

Tokenized private equity and rent rolls are also being onboarded in parallel, creating a diversified ecosystem of yield-generating, tokenized real assets.

The Bigger Picture: Tokenized Sustainability

The implications are vast. Redbelly is demonstrating that tokenization isn’t just about hype or speculation—it’s about building tools for a measurable climate impact.

By digitizing assets like carbon credits and linking them to programmable smart contracts, Redbelly enables use cases like:

-

Automated ESG reporting

-

Green bond issuance

-

Real-time impact tracking

-

Scalable, borderless environmental finance

Closing Thoughts

This move by Redbelly Network is not just a win for blockchain, but a bold reimagination of how climate finance can scale responsibly.

Tokenizing $70 billion in carbon credits signals more than technological progress—it signals a commitment to real-world impact, regulatory integrity, and a greener, more transparent financial system.

As institutional adoption accelerates and environmental urgency increases, Redbelly could become the cornerstone of next-gen carbon markets.