Bitcoin is navigating a critical test as it trades slightly above the $110,000 mark, with bulls working to defend key support after last Friday’s sharp crash. The market remains tense, and sentiment is split between hopes of recovery and fears of another leg down.

After one of the most volatile weeks of the year, BTC is showing signs of consolidation, but uncertainty dominates as traders assess whether this is the start of a stabilization phase or a temporary pause before another sell-off. Analysts note that price structure remains fragile, and momentum indicators suggest the market needs stronger demand inflows to sustain current levels.

Meanwhile, onchain data points to notable whale activity. Several newly created wallets have been observed withdrawing large amounts of Bitcoin from major exchanges, signaling that some large investors may be moving assets to cold storage — a move often interpreted as a sign of accumulation or strategic repositioning.

These flows highlight the ongoing tug-of-war between market fear and institutional interest. As the market seeks direction, traders are closely watching whale behavior for clues about whether this consolidation will turn into a rebound — or another wave of volatility.

Whale Activity Signals Strategic Accumulation

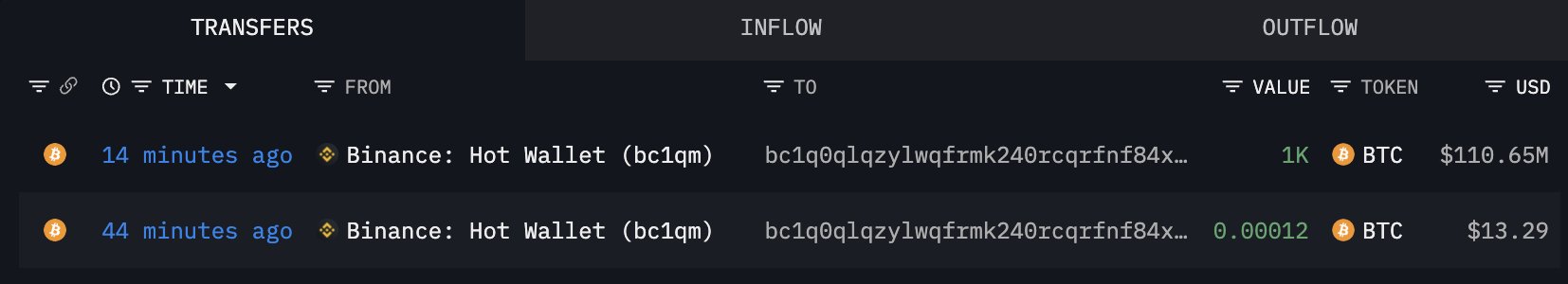

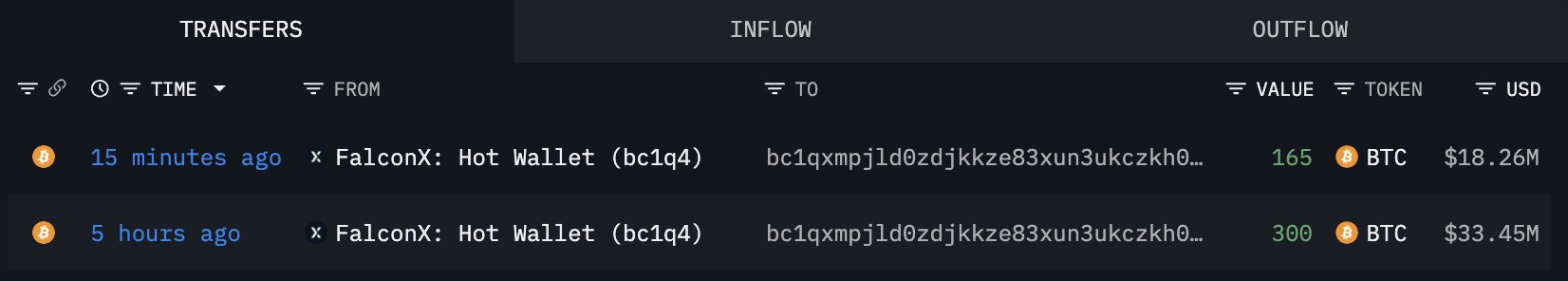

Data from Lookonchain shows renewed whale activity as Bitcoin consolidates near the $110K mark. A newly created wallet, bc1q0q, withdrew 1,000 BTC ($110.65 million) from Binance, while another wallet, bc1qxm, pulled 465 BTC ($51.47 million) from FalconX over the past five hours. These two withdrawals — totaling more than $160 million in Bitcoin — have caught the attention of analysts tracking institutional and large-scale investor flows.

Historically, such movements of newly created wallets withdrawing significant sums from exchanges tend to indicate accumulation behavior rather than short-term speculation. When large players move funds off exchanges, it typically signals reduced selling intent and a preference for holding BTC in self-custody — a bullish long-term sign, even amid short-term market weakness.

However, this doesn’t mean volatility is over. The market remains fragile after last week’s sharp drop, and many traders expect a period of sideways consolidation before any clear directional move. Bitcoin may continue to hover within the $108K–$115K range as it absorbs recent liquidations and rebuilds structure.

Bitcoin Bulls Defend $110K Support Amid Consolidation

Bitcoin continues to hover around $111,300, showing resilience after last week’s sharp crash that briefly sent prices near $103,000. The chart reveals that BTC is currently consolidating just above the $110K support zone, a key area that has repeatedly acted as a short-term floor during past corrections.

Price action shows limited momentum, with the 50-day moving average (blue line) sloping downward and acting as resistance near $115K, while the 200-day moving average (red line) sits around $107K, providing a broader structural base. This setup suggests that Bitcoin remains in a neutral-to-bearish short-term phase, as buyers and sellers continue to battle for control within a tightening range.

For now, the $117,500 level remains the key resistance to reclaim if BTC wants to confirm a recovery trend. A decisive breakout above this zone could trigger renewed momentum toward $120K–$122K. Conversely, a drop below $109K would likely extend the correction toward $106K.

Market sentiment remains cautious but stable. Consolidation at these levels could allow BTC to rebuild support and reset indicators before attempting another move, making the current phase critical for determining the next major direction in price action.

Featured image from ChatGPT, chart from TradingView.com