Crypto commentator Zach Rector argues that XRP’s months-long malaise is nearing a turning point, contending that selling pressure has largely run its course and that a fresh wave of institutional demand is lining up on the other side of the ledger. “XRP sellers are exhausted,” Rector said in a video analysis published late on October 9, adding that “the downside action and the consolidation that we’ve seen over the past few months is coming to an end and the suits are now getting ready to sell it with slideshow presentations.”

Reasons To Be Bullish On XRP

Rector’s central thesis is that structurally constrained float and prospective exchange-traded products could catalyze a supply squeeze. He framed the timeline around a US government shutdown, asserting that approval activity would not resume until after a reopening: “ETFs are set to go live for XRP as soon as the government shutdown ends. No, I am not anticipating the SEC to approve the ETFs while the government is shut down.” He characterized the post-shutdown period as a potential “tidal wave of XRP, crypto, and other related ETFs,” while acknowledging that the precise sequencing depends on regulators returning to normal operations.

Pointing to what he sees as a template in other assets, Rector highlighted a recent trading episode he attributed to BlackRock’s Ethereum ETF. In his telling, “Jane Street… spark[ed] a massive momentum ignition selloff just in time for BlackRock’s ETF to buy the most Ether in 2 months,” with $437 million of inflows arriving on a day of heavy price weakness.

“While they’re hitting the sell button, panicking… the investors at BlackRock are saying, ‘Thank you very much,’” he said. He extrapolated from this to XRP, claiming “the suits have the champagne on ice cuz they know that they’re about to go break records with the XRP ETFs.”

Beyond the ETFs, Rector emphasized on-chain and DeFi dynamics that he believes reduce liquid supply. He cited activity around Flare’s FXRP mechanism, describing wallet flows and escrowed balances as visible on public ledgers: “So far, Flare has already locked up almost $60 million worth of XRP. That’s equivalent to about 20 million XRP.”

Rector broadened his supply-tightening thesis to digital asset treasury (DAT) companies, asserting they had “already actually acquired 10% of the overall Ethereum supply” and were now “coming for XRP.”

XRP Momentum Builds

He also alluded to tokenization and payments initiatives he associates with Ripple and the XRP Ledger, asserting that “they really are going to tokenize on the XRP Ledger” and bring “flows of liquidity that are valued in the trillions of dollars” onto the network. As evidence of institutional momentum, he pointed to European and Middle Eastern developments.

Citing a post from VanEck’s Matthew Sigel, he said “Luxembourg becomes the first EU sovereign wealth fund to buy Bitcoin with a 1% position via ETF,” and noted recent meetings between Ripple executives and Luxembourg’s finance minister. He also referenced Ripple’s expansion in the Middle East, including Bahrain, as reinforcing an institutional pipeline.

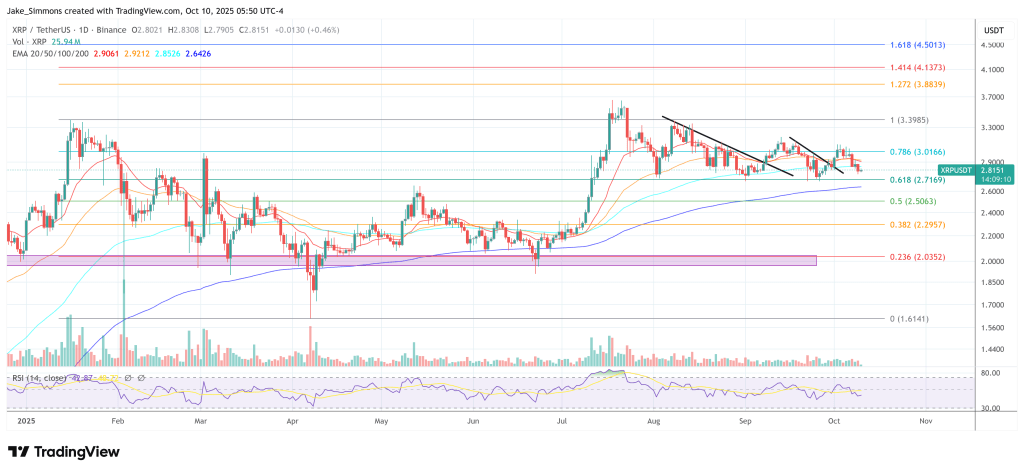

On market structure, Rector said the recent intraday push lower found support above a level he is monitoring. “I zoomed out… to when we last back tested $2.70 just to show you… support,” he said, noting a visit to “about 2.77… people are front running that $2.70 level… we’re up to $2.81.”

For investors worried that a peak is already in, he pushed back: “Was that the end of the XRP bull run? Did I just miss the top at 3.66? Absolutely not… imagine thinking that now’s the time to sell when Wall Street’s about to start selling it for you.”

Rector’s explicit forward targets were sweeping. He said newcomers could “still… triple it up at least by next year,” and that a “10x” remained plausible under his “$20 to $30 base case,” characterizing “double-digit XRP” as “easily done.”

Throughout, he tied the outlook to a cluster of catalysts—“ETFs, digital asset treasury companies, and institutional adoption”—and to what he regards as a steady constriction of tradable float via DeFi lockups. “That’s what leads to a supply shock,” he said. “This party’s just getting started.”

At press time, XRP traded at $2.815.