Introduction

Despite Beijing’s stringent crackdown on cryptocurrency trading, underground brokers in China continue to facilitate transactions, allowing individuals to convert large amounts of yuan into digital assets. This persistent activity highlights the ongoing struggle between the Chinese government and crypto traders who seek to bypass capital controls.

The Government’s Stance on Cryptocurrency

China has imposed a series of bans on cryptocurrency-related activities over the years. From restricting financial institutions from handling crypto transactions to outlawing crypto mining and exchanges, the government aims to maintain control over the financial system and prevent capital outflows. In 2021, China’s central bank, the People’s Bank of China (PBOC), declared all crypto transactions illegal, reinforcing its tough stance against digital currencies.

The Underground Crypto Market

Despite these restrictions, underground brokers and traders have found ways to continue operating. Some of the methods include:

- Over-the-Counter (OTC) Trading: Many individuals use OTC desks that operate discreetly, leveraging encrypted messaging apps and private networks to facilitate transactions.

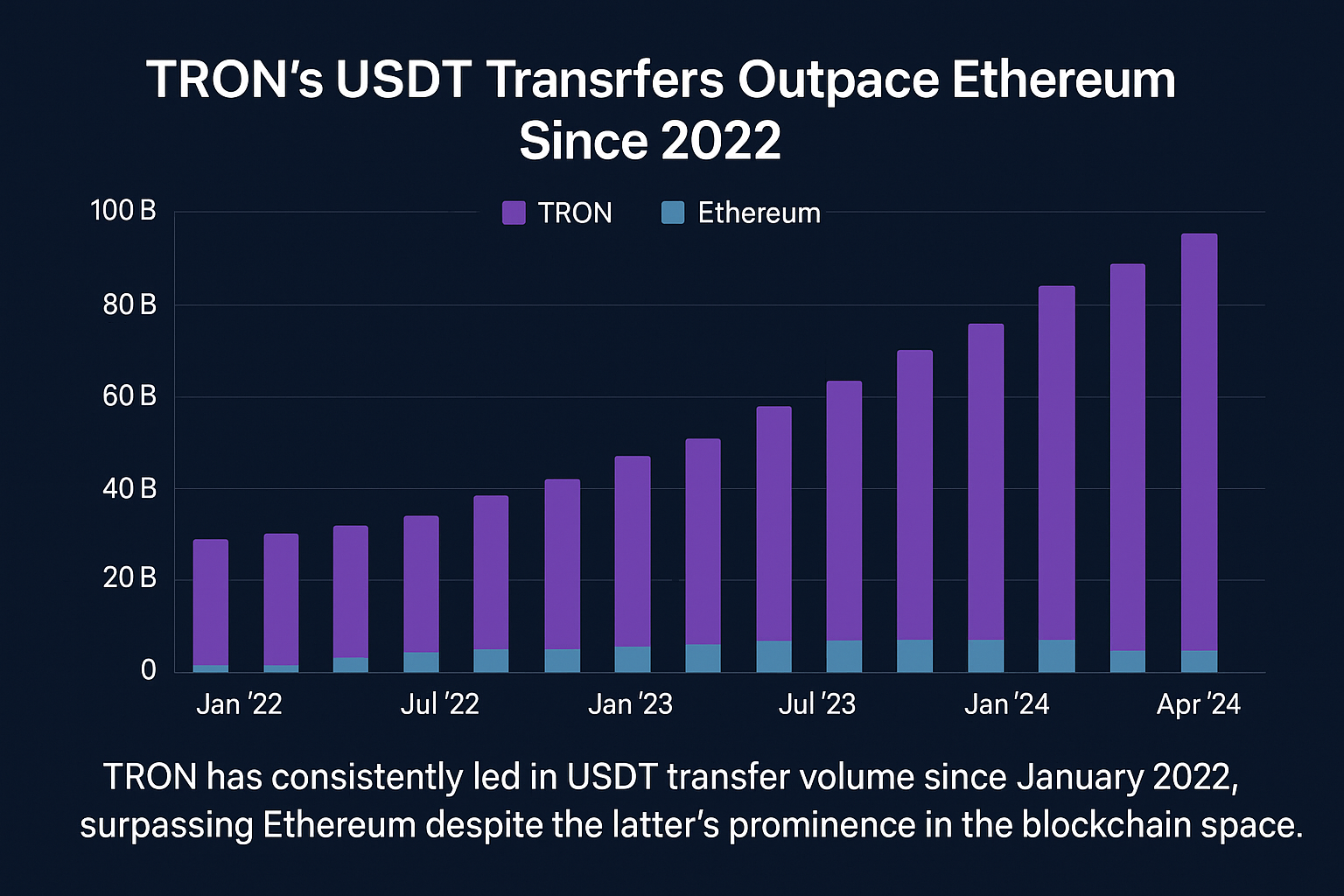

- Tether (USDT) as a Bridge Currency: Traders often use stablecoins like Tether (USDT) to move funds internationally, as it is pegged to the U.S. dollar and widely accepted in global crypto markets.

- Decentralized Finance (DeFi) Platforms: With decentralized exchanges (DEXs) like Uniswap and dYdX, Chinese traders can conduct peer-to-peer transactions without intermediaries.

- Hawala-style Remittance Networks: Informal money transfer systems allow individuals to exchange yuan for crypto through personal trust-based arrangements, circumventing government monitoring.

Beijing’s Countermeasures

The Chinese government continuously adapts its strategies to counter crypto-related activities, including:

- Increased Surveillance: Authorities monitor online discussions, transaction records, and mobile payment platforms to detect illicit crypto activity.

- Crackdowns on OTC Brokers: Law enforcement regularly arrests individuals involved in illegal crypto trading, shutting down major underground operations.

- Stricter Banking Regulations: Financial institutions are required to block crypto-related transactions and report suspicious activities.

- Blockchain-Based Digital Yuan (CBDC): China is actively promoting its central bank digital currency (CBDC) as an alternative to decentralized cryptocurrencies, aiming to maintain monetary control.

The Future of Crypto in China

Despite continuous government efforts, underground crypto trading persists, showing the resilience and adaptability of traders. With global digital finance evolving rapidly, China faces an ongoing challenge in fully eradicating decentralized digital assets. The cat-and-mouse game between regulators and crypto enthusiasts is set to continue, shaping the future of digital finance in China.

China’s stringent crypto policies have not eradicated trading but have pushed it into the shadows, creating a highly adaptable underground market. While Beijing remains committed to tightening controls, the demand for crypto as a means of financial freedom ensures that the battle is far from over. The future will depend on how both traders and regulators adapt to the evolving financial landscape.