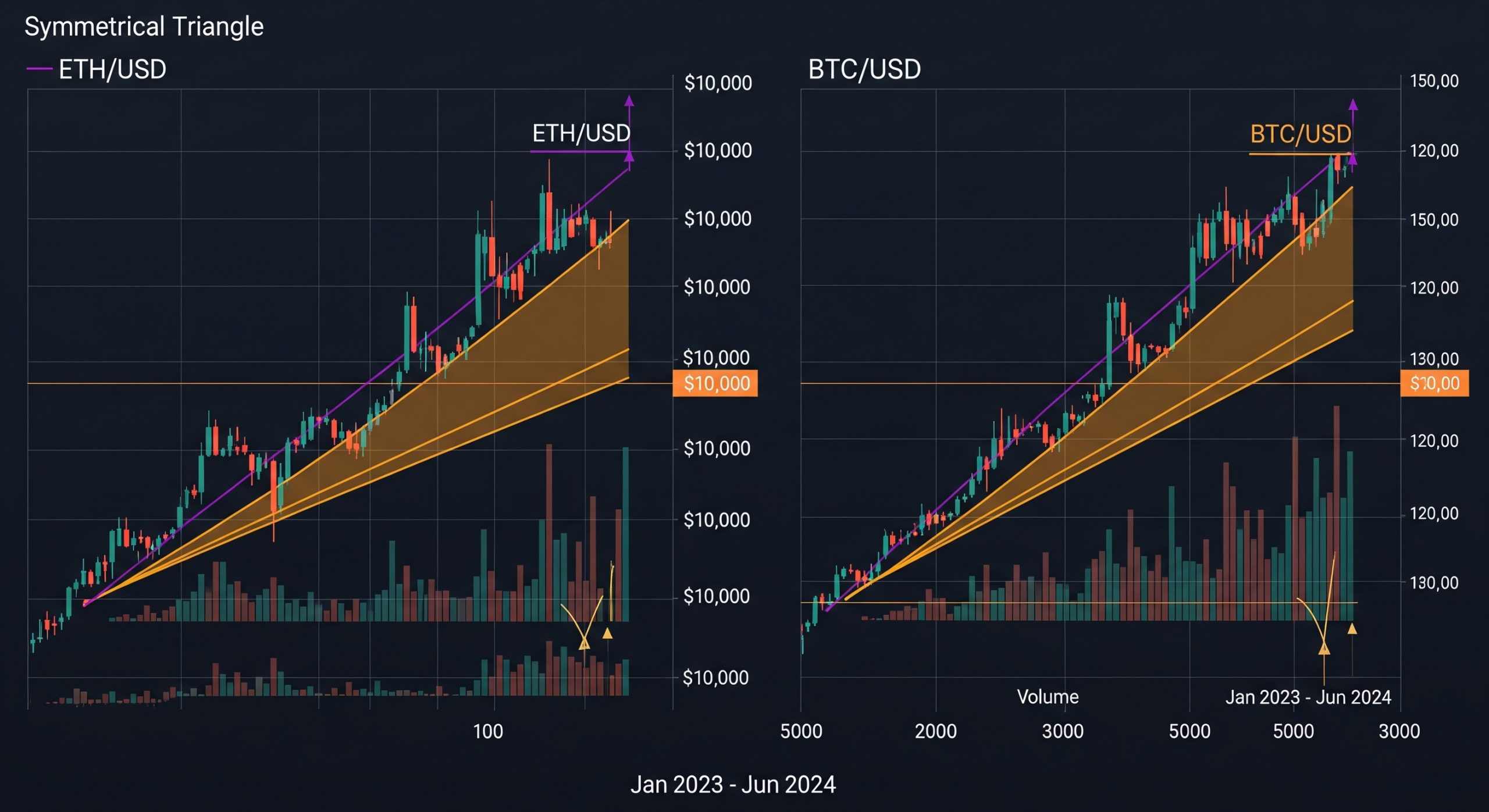

Ethereum (ETH), the second-largest cryptocurrency by market cap, is currently displaying a technical structure that has traders leaning in with cautious optimism. The formation? A symmetrical triangle — a classic chart pattern often associated with impending breakouts. It’s a setup that’s drawing comparisons to Bitcoin’s 2020 breakout, which preceded its legendary bull run.

The Pattern: Consolidation with a Twist

A symmetrical triangle forms when the price of an asset is compressing between two converging trendlines — lower highs and higher lows. This pattern typically signals a period of consolidation before a significant price move. Importantly, it doesn’t inherently indicate direction — it’s a coiled spring that can launch upward or downward. However, in the context of broader market sentiment, Ethereum’s triangle is being seen as a bullish continuation pattern.

In the last week, ETH posted a 2.6% gain, further fueling hopes that a breakout to the upside is on the horizon. While modest, this gain is significant within a larger pattern of tightening price action — and it comes amid growing anticipation around Ethereum’s evolving ecosystem and institutional interest.

Echoes of Bitcoin’s 2020 Setup

Veteran crypto traders can’t help but notice the eerie similarity to Bitcoin’s technical structure in late 2020. Back then, BTC spent months consolidating within a symmetrical triangle before decisively breaking out above $12,000 — a move that eventually carried it to all-time highs above $60,000 in 2021. Ethereum’s current setup, combined with increasing on-chain activity and network improvements, has led many to speculate that ETH could be preparing for a similar trajectory.

Fundamentals Fueling the Fire

Several factors are adding momentum to the technical setup:

-

ETH ETF Hopes: With the recent progress toward Ethereum spot ETFs in the U.S., institutional demand could see a major spike.

-

Staking Growth: ETH staking continues to grow post-merge, tightening supply and adding long-term holding incentives.

-

Layer 2 Expansion: Rollups like Optimism and Arbitrum are seeing strong adoption, reinforcing Ethereum’s scaling roadmap.

All of this contributes to a narrative that Ethereum may not just break out of its triangle — it may break into a new era of maturity and capital inflow.

Risk Still Looms

While optimism is warranted, caution is equally important. Symmetrical triangles can break in either direction, and macroeconomic conditions — including inflation data, regulatory decisions, or a sudden drop in Bitcoin — could quickly invalidate bullish expectations.

Traders are watching key resistance levels around $3,200 and support near $2,800. A decisive close above the upper trendline with volume confirmation could be the green light bulls are waiting for.

ETH at a Crossroads

Ethereum’s symmetrical triangle is more than just a technical curiosity — it’s a moment of potential inflection for the entire crypto market. Whether this setup will echo Bitcoin’s 2020 breakout or serve as a false alarm remains to be seen. But with strong fundamentals, positive weekly performance, and a growing sense of anticipation, all eyes are on ETH’s next move.