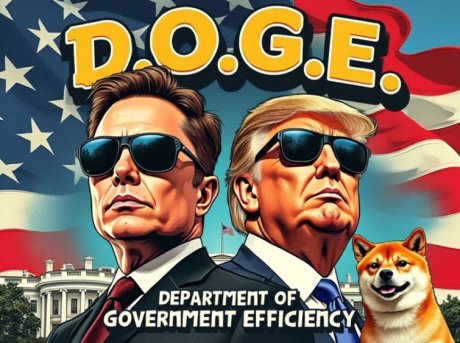

Elon·MuskElon Musk“It’s About Time” once again stirred up the meme world, and also brought the Dogecoin story that had been dormant for several weeks back into the community’s focus. and2021Compared with the hot market in 2018, the current market environment is more conservative. Macroeconomic pressure, liquidation cascades and insufficient liquidity mean that Musk’s influence can no longer drive the overall market reversal alone.

But for this reason, the direction of the movement of money has become particularly importantNoteworthy: On the one hand, there are the memetic feelings brought about by the musk;Bitcoin HyperThis type of jobLayer2The project quickly absorbed huge sums of money, which presented a sharp contrast and also revealed changes in funding preferences.

Musk’s signal sparks coin hunt,Doug–1Focus on the short term

Musk this weekXLeave a short message on the Dogecoin community, making the entire Dogecoin community active instantly. AlthoughDogecoinIt itself did not rebound as strongly as expected, and the price fell at once0.16The dollar is close, but the rotation within the meme sector is very intense. Especially withSpaceXA project with the same nameDWG-1The token, sought by speculators, has risen nearly three times in a short period of time, even attracting participation from heavyweight traders across the chain.

The most striking among them isGood sunThis meme trader, known for his high turnover, spends hundredsSolPurchased1627Thousands of piecesDWG-1. His previous trading history has accumulated profits of over $2.8 million, and any action will be taken as an indicator of short-term sentiment. AlthoughDWG-1Then it fell due to profit-taking, but this rapid rise and fall rhythm demonstrated the unique speculative laws of meme assets, and also reflected that the market relied more on momentary emotions than on long-term funds in a weak environment.

At the same time,DWG-1The real satellite mission behind it is still being planned and is expected to be2025It will launch at the end of the year, making some traders bet that there could be new news catalysts ahead. As the macro environment continues to fluctuate, the meme environment remains dynamic, but participants generally adopt short-term strategies, prioritizing speed over patience.

The market is looking for more reliable narratives amidst volatility

Bitcoin’s sharp decline in early November pushed the market towards a risk-off structure. The Federal Reserve’s hawkish tone, global economic uncertainty, and the panic caused by mounting liquidations have made traders more cautious about high-risk assets. Even if Musk mentions Dogecoin again, he has failed to directly spark a widespread craze like in previous years. The rapid rise of cryptocurrencies has been suppressed by profit-taking, reflecting the current high sensitivity of funds to liquidity and speed of exit.

Against this backdrop, the market is beginning to see another clear trajectory: projects with technical foundations, a complete narrative, and traceable progress are more likely to become funding destinations. That’s exactly itBitcoin HyperThe main reason for its rise. While meme narratives provide emotional stimulation,Layer2A job provides measurable future valueValue, the two are in sharp contrast at this moment.

Bitcoin HyperAttract more than2600million dollars,Layer2The revolution becomes a new axis

Bitcoin HyperIn the pre-sale stage, it quickly accumulated more than2600The capital of ten thousand US dollars and orders in large quantities were maintained for several days in a row. The most striking thing is a large whale-level transaction from a single address a few days ago, with a single transaction amount of up to31million dollars, setting a new record for personal purchases in a single day since the project’s pre-sale.10moon6A huge purchase of whales was also recorded that dayMore than26Million dollarsWhich sparked widespread concern.

This level of buying often symbolizes strong market recognition of the project’s direction, and also represents BitcoinLayer2Narrative has become the new focus of this market cycle.

Bitcoin HyperThe crux of the matter is to make Bitcoin truly programmable. The project structure depends onSolanaVirtual machine, createBitcoinAbility to share in a low latency mannerDecentralized finance,game,She deniedWith high frequency payments. The non-retaining bridge design allows assets to be freely inserted and exited without sacrificing the security of the original chain. This ability trumps the fact that Bitcoin has always been used only as a storeLimits of value tool, also letBitcoinTowards larger application scenarios.

excessiveThe token price is automatically adjusted every three days, creating a natural entry rhythm during the pre-sale period. The areal rate of return is close to44%And transaction fees and governance and everythingLayer2Activities are usedexcessiveWhich makes the token itself the primary driving force for the entire network. He comes out2025After the mainnet goes online in the last quarter of this year, the full application layer will be gradually revealed. The market expects this to be a rare functional leap in the Bitcoin ecosystem.

For many long-term investors,Bitcoin HyperIts appeal lies not only in the pre-market growth space, but also in its potential to solve Bitcoin’s most controversial bottlenecks of the past 15 years: speed, programmability, and cross-application capabilities.

Buy official websiteBitcoin Hyper

Conclusion: Memes Vs.Layer2There are two axes running in parallel, and a new narrative is being formed

Musk reignites the meme craze, pitting Dogecoin againstDWG-1The short term is active, but the macro pressure makes investors more cautious, and the meme market shows a rapid back-and-forth structure. In comparison,Bitcoin HyperIt represents another type of market demand: finding projects with technical depth, clear structure, and actual measurable growth potential amidst volatility.

On the one hand, there is emotional flow, and on the other hand, there is functional innovation; On the one hand, we follow short-term breakouts, and on the other hand, we build a medium-term pricevalue. When two narratives progress simultaneously,2025In 2020, the market is likely to see a completely different investment rhythm. andBitcoin HyperIn light of this pattern, Bitcoin has become the most viewedLayer2New core and a chance to really kick off the altcoin seasonStart to occupy a major position.

Editing process Bitcoinist focuses on providing well-researched, accurate, and unbiased content. We adhere to strict sourcing standards, and every page is carefully reviewed by our team of senior technology experts and experienced editors. This process ensures the integrity, relevance, and value of our content to our readers.

The post Elon Musk再點燃狗狗幣話題 市場資金轉向下個爆炸性百倍迷因幣Bitcoin Hyper first appeared on Investorempires.com.