Dogecoin sits at a technically pivotal juncture, according to crypto analyst CantoneseCat (@cantonmeow), who argues that the next decisive inflection arrives at $0.54—“the final boss”—if the coin can translate an increasingly constructive multi-timeframe structure into weekly acceptance above the Ichimoku cloud.

Recording just hours ahead of the weekly close on September 14, he framed DOGE’s backdrop as a steady, methodical rebuild powered by higher-timeframe support retention rather than headline-driven spikes. “I am bullish on Dogecoin,” he said. “There is nothing that I’m really too bearish about here.”

Dogecoin Charge Stalls At Ichimoku Wall

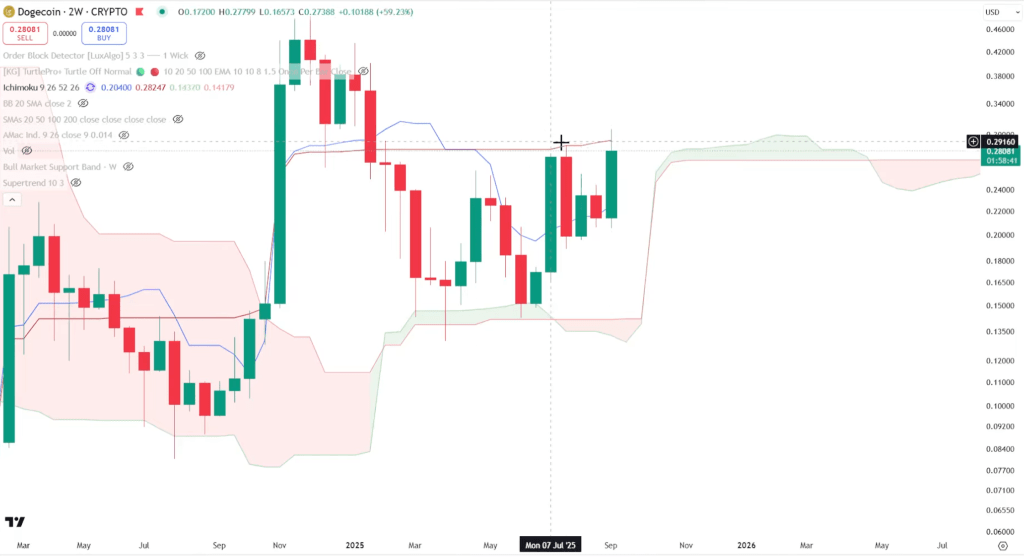

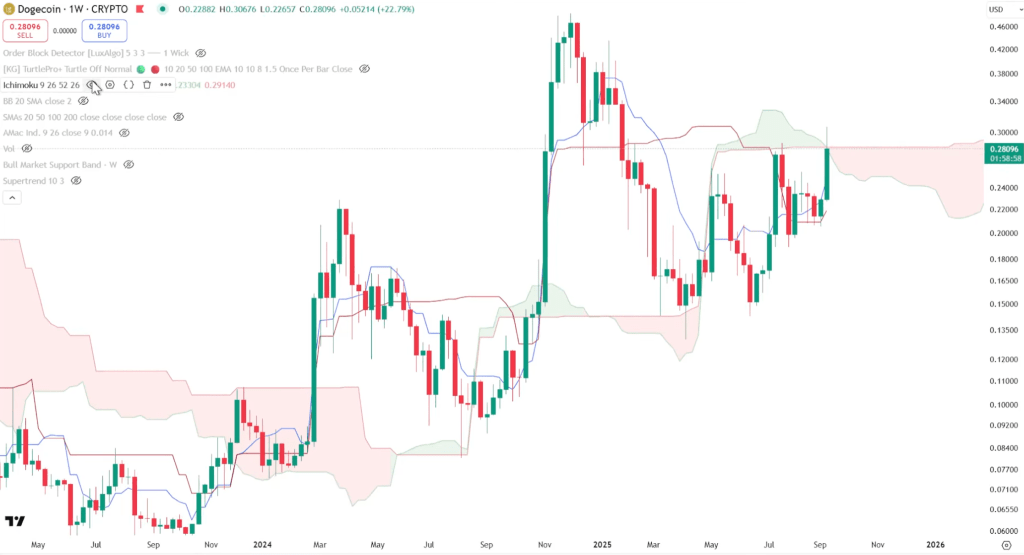

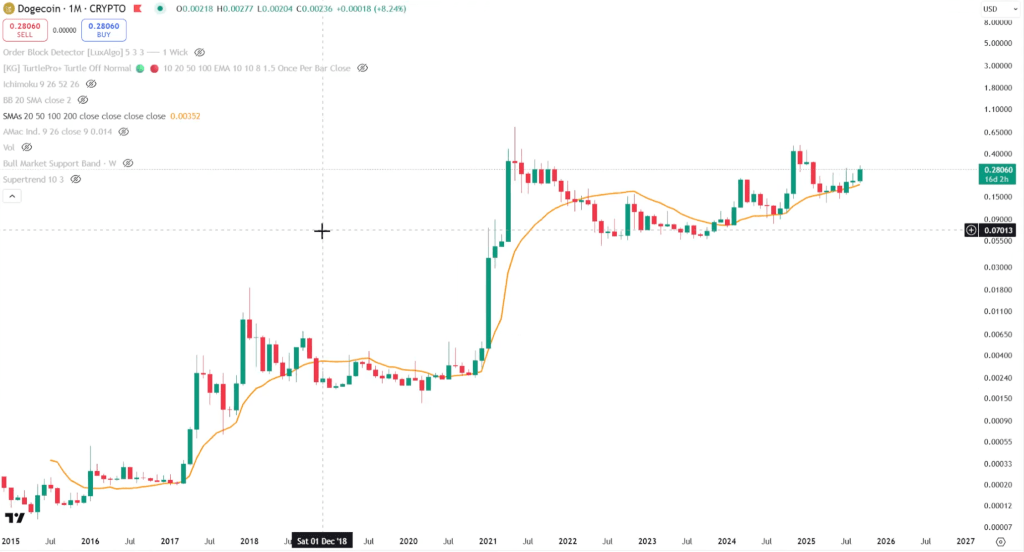

The crux of his view is that Dogecoin has reclaimed and maintained the key foundations that historically precede its expansion phases. On the monthly chart, price has pushed into the Ichimoku cloud and continues to respect the 20-month moving average as positively sloping support.

He emphasized how that moving average has repeatedly served as the trampoline for prior advances: “Every single time whenever it served as support, it’ll push up higher.” In parallel, DOGE has re-engaged the upper Bollinger Band on the weekly timeframe while staying above the 20-week moving average—a configuration that, in his read, signals persistent underlying demand, even if the first contact with overhead resistance produces hesitation.

The weekly and two-week Ichimoku structures dominate his near-term roadmap. On the two-week chart, he described “a V-shaped recovery as good as it’s going to get,” with the Kijun acting as the immediate ceiling.

On the weekly, he expected the close to determine whether the coin could transition from probing resistance to establishing trend continuation. If the first attempt failed, he said, the setup would remain intact provided the 20-week moving average continued to rise and DOGE preserved its higher-lows structure inside the cloud. The path forward, in his words, remains “one level at a time.”

Fibonacci confluence is the second pillar. CantoneseCat places strong weight on the 0.618 logarithmic retracement as the “gatekeeper” for DOGE’s next leg. A confirmed weekly and monthly hold above that line, he contends, would elevate the probability of a measured run into clustered resistance near $0.33 and $0.41, culminating in a test of $0.54.

He repeatedly characterized $0.54 as the breakpoint that would flip the narrative from range-bound to trending. “If we close the week above the 0.618, then it does increase the possibility of challenging some of these higher levels at 33 cents, 41 cents and then 54 cents—going to be the final boss,” he said. Clearing that final boss, he added, would put “all-time highs” back on the table without asserting a timeline.

The analyst also acknowledged that broader beta still matters at the margin. Bitcoin’s weekly posture around its 20-week Bollinger midline and Tenkan line, he said, often determines whether crypto spends weeks grinding higher or sliding into lower-band purgatory. Into the weekend, he thought BTC was “reclaiming the 20-week,” with a Bollinger squeeze that “anticipate[s] a bigger move to come.”

That matters for DOGE primarily insofar as a constructive BTC backdrop tends to relax risk constraints and allow altcoin momentum to express. But the Dogecoin call stands on its own technical legs: monthly cloud engagement, two-week V-recovery, a positively sloped 20-week average, repeated upper-band taps, and—crucially—the 0.618 hold.

CantoneseCat also cautioned against over-interpreting the need for perfect retests. On Bitcoin he noted that markets sometimes “manufacture some kind of news” to justify a sweep, a dynamic that can just as easily play out on DOGE during liquidity hunts. For Dogecoin, that means allowing for shallow backfills toward dynamic supports without declaring the structure broken. His emphasis was on continuation patterns—notably flags—forming above reclaimed levels rather than on deep resets.

Targets remain crisp and conditional. The first objective is to maintain acceptance above the 0.618 log Fib on weekly and monthly closes. From there, he expects a stair-step sequence through approximately $0.33 and $0.41 before any credible assault on $0.54. He was explicit that $0.54 is the battlefield that would decide whether Dogecoin can transition from a constructive recovery to a trend acceleration phase. Only a weekly breakout and subsequent conversion of the cloud into support would validate that shift.

Dogecoin Weekly Close Is Mixed

After the weekly candle printed, CantoneseCat confirmed the mixed—but still constructive—result. “DOGE weekly candle closed below the Ichimoku cloud, but a newly forming weekly candle is now inside the Ichimoku cloud to start the week,” he wrote. In a second note he added: “$DOGE closed the week above 0.618 log fib.”

Practically, that outcome preserves the bullish scaffolding while postponing a definitive cloud break by at least another bar. The hold above the 0.618 keeps the $0.33 and $0.41 magnets active; the early push back into the cloud suggests momentum is attempting to re-assert. The thesis remains unchanged: as long as Dogecoin defends the 0.618 and the 20-week moving average continues to slope higher, the market will keep steering toward a confrontation with the $0.54 “final boss.”

At press time, DOGE traded at $0.2629.