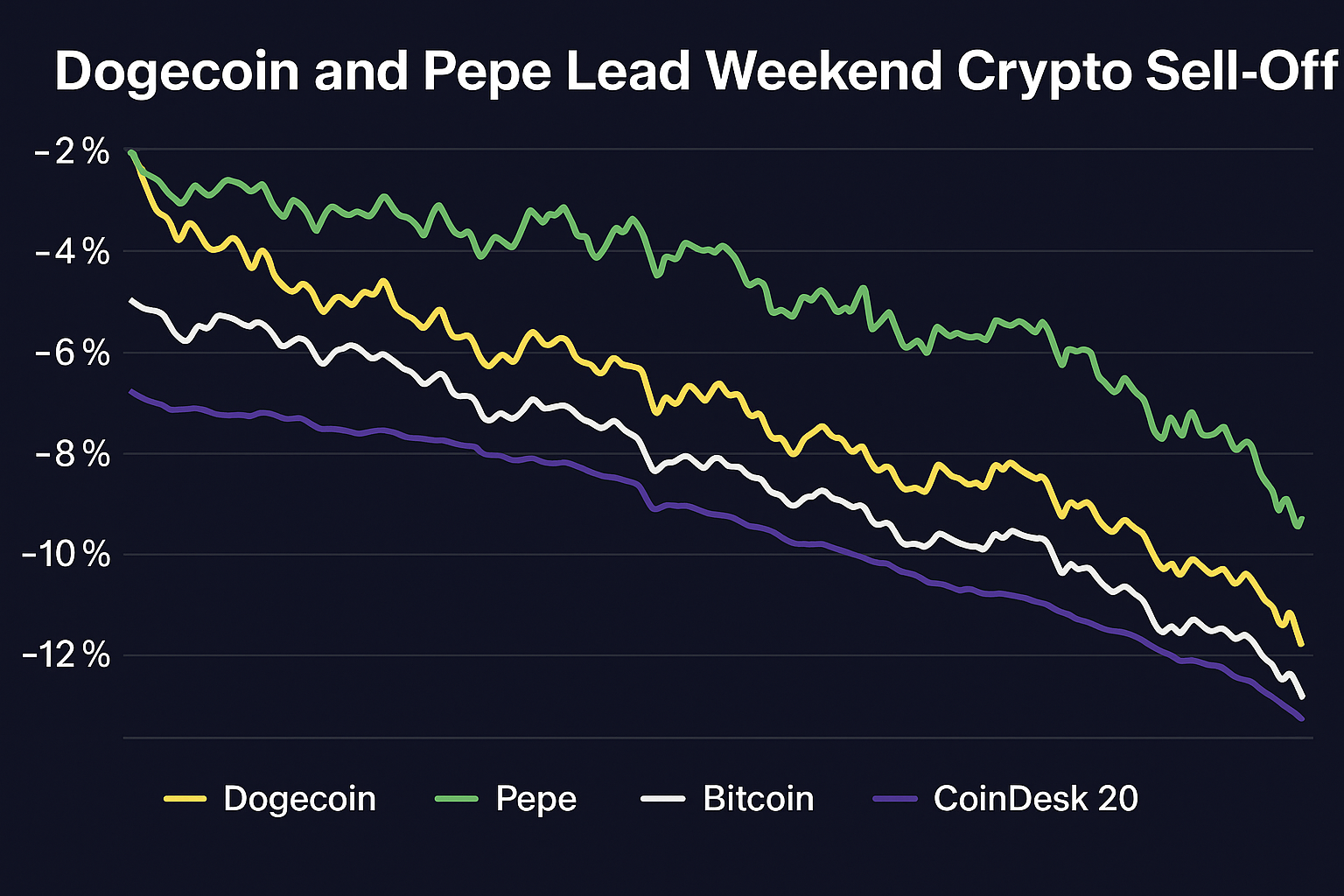

The cryptocurrency market faced a sharp correction over the weekend, with meme coins taking the brunt of the sell-off. Dogecoin (DOGE), long known for its volatility and social media-driven price swings, plunged more than 8%, while Pepe (PEPE), another meme-inspired token, suffered a steep 12% drop. These declines significantly outpaced Bitcoin’s more modest 2% fall, which left the leading cryptocurrency trading just above $103,600.

Meanwhile, the broader CoinDesk 20 index, which tracks major crypto assets, declined by 4.2%, highlighting a broader risk-off sentiment among investors.

Meme Coins Hit the Hardest

While cryptocurrencies across the board were in the red, Dogecoin and Pepe stood out due to their accelerated losses. This is not the first time that meme coins have led the downturn — their high volatility, speculative nature, and heavy retail ownership often make them particularly vulnerable during bearish market conditions.

Dogecoin’s drop appears tied to a wider pullback from high-risk assets, especially among retail investors. The token, which was once buoyed by endorsements from Elon Musk and other high-profile figures, is again facing the challenge of proving long-term utility.

Pepe, which saw a meteoric rise earlier this year, is now showing the dark side of meme token hype: a rapid descent in price as momentum wanes and speculative buyers retreat.

Bitcoin and Major Alts Also Under Pressure

Bitcoin’s dip of over 2% may seem modest in comparison, but it reflects growing unease in the market. Economic uncertainty, continued regulatory pressures, and profit-taking after recent rallies have all contributed to the current trend. Despite this, Bitcoin remains a relatively stable asset in a highly volatile space, and its ability to hold above the $103,000 level is being closely watched by traders.

Ethereum and other altcoins also saw moderate declines, though none as severe as the top meme tokens.

What’s Next?

Analysts caution that further downside could be in store if investor confidence doesn’t recover quickly. The coming week will be critical: any signs of institutional inflows or renewed retail interest could stabilize prices. On the flip side, a break below key support levels for Bitcoin could drag the entire market down further.

For now, the message is clear: high-risk assets like meme coins are the first to fall when sentiment turns bearish. Investors would do well to reassess their risk tolerance and stay updated on macroeconomic triggers that may continue to shake the market.