In mid-2025, the crypto landscape is experiencing a profound evolution. From the booming derivatives sector to the next-gen infrastructure driving token utility, platforms like Hyperliquid and Bybit are at the heart of this transformation.

A New Era for Crypto Innovation

The crypto industry in 2025 looks markedly different from the speculative boom-bust cycles of the past. Recent analyses published by The Cryptonomist and Bankless Times reveal that we’re now entering a maturity phase—where token innovation, rather than hype, fuels momentum.

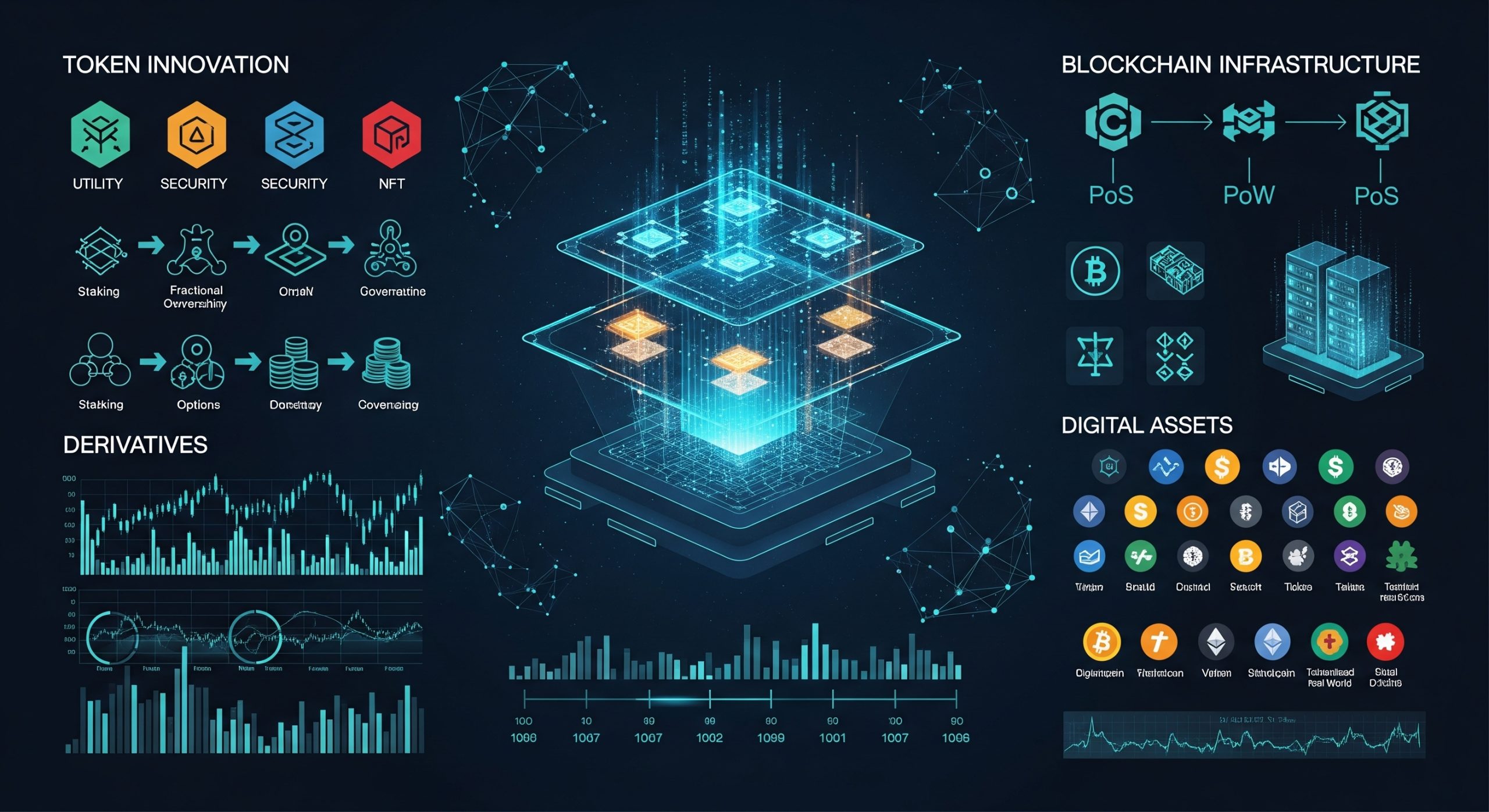

Two of the most dynamic sectors showing growth are:

-

Derivatives: Sophisticated tools for hedging and speculation.

-

Token Infrastructure: Systems enabling smarter, more efficient token launches and utilities.

Hyperliquid and Bybit have emerged as frontrunners, not merely as trading platforms but as incubators of Web3 ecosystems.

Hyperliquid: Powering Web3-native Derivatives

Hyperliquid has become a key driver in decentralized derivatives. With on-chain perpetuals, deep liquidity pools, and high-frequency trading tools, the platform offers something previously limited to TradFi: speed and scalability with transparency.

But what truly sets Hyperliquid apart is its role in launching and supporting tokens natively tied to the platform. These tokens often carry real economic utility, such as governance rights, collateral functions, and even NFT cross-integration.

Bybit: Bridging NFTs, Token Launches, and Retail Traders

Bybit, once known mainly for perpetual futures, has expanded into a multifaceted launchpad and NFT investment platform. In 2025, the exchange plays host to tokenized treasuries, metaverse land sales, and experimental community-driven tokens.

Its recently launched Web3 Wallet Suite includes support for NFT-backed staking, allowing users to earn yield on collectibles—bridging DeFi and digital art in new ways.

Moreover, Bybit’s incubation arm has helped over 70 new projects go to market in the first half of 2025, providing everything from technical advisory to liquidity bootstrapping.

Token Utility Takes Center Stage

A key insight from recent platform analyses is that utility is no longer optional. The top-performing tokens in 2025 are those backed by strong use cases, such as:

-

Real-world asset tokenization

-

Gaming and metaverse interoperability

-

Governance and DAO coordination

-

Incentivized liquidity in DeFi protocols

Platforms are responding by embedding infrastructure that supports custom smart contract modules, NFT composability, and real-time data oracles, which drastically increase what tokens can do, not just what they represent.

What This Means for Investors and Builders

The rise of incubator-style platforms signals a paradigm shift. For investors, it means more structured opportunities and a deeper due diligence layer. For builders, the infrastructure is now in place to go from whitepaper to protocol without relying on VC gatekeepers.

As 2025 progresses, expect to see more hybrid tokens—blending yield, governance, and utility across multiple ecosystems.

The innovations taking place within platforms like Hyperliquid and Bybit are not isolated. They represent a broader trend in crypto: the shift from speculation to sustainable, infrastructure-led growth.

Token innovation is no longer a niche—it’s the cornerstone of crypto’s next act.