The cryptocurrency market is poised for major growth in 2024, fueled by two significant events: the upcoming Bitcoin halving and the rise of Bitcoin exchange-traded funds (ETFs). These developments are not only influencing the price of Bitcoin but also sparking broader interest in altcoins and decentralized finance (DeFi) solutions.

The Impact of the Bitcoin Halving

The Bitcoin halving, expected in 2024, is one of the most highly anticipated events in the crypto space. This process reduces the block reward for miners by half, decreasing the rate at which new Bitcoin is generated. Historically, Bitcoin halvings have been catalysts for significant price surges due to the supply-and-demand dynamics they create. As the supply of new Bitcoin slows, demand typically increases, driving up the price. Analysts and crypto enthusiasts are already predicting a bullish year for Bitcoin, with some forecasting that its price could reach new all-time highs.

Bitcoin ETFs: A Game Changer

In addition to the halving, the approval and proliferation of Bitcoin ETFs are expected to further drive market expansion. Bitcoin ETFs allow traditional investors to gain exposure to the cryptocurrency without having to buy and store the digital asset directly. This financial product has been seen as a major step toward the mainstream adoption of Bitcoin, as it lowers the barrier to entry for institutional and retail investors alike. The growing interest in ETFs is seen as a key driver of Bitcoin’s price, as it broadens the market base and brings in capital from more conservative investors.

Altcoins Benefit from Bitcoin’s Momentum

The momentum surrounding Bitcoin has also generated increased interest in popular altcoins like Shiba Inu and Dogecoin. These tokens, while initially considered meme coins, have developed strong communities and use cases, particularly in the areas of microtransactions and digital tipping. As Bitcoin garners attention, these altcoins tend to follow suit, attracting speculative investors looking to capitalize on the broader market expansion.

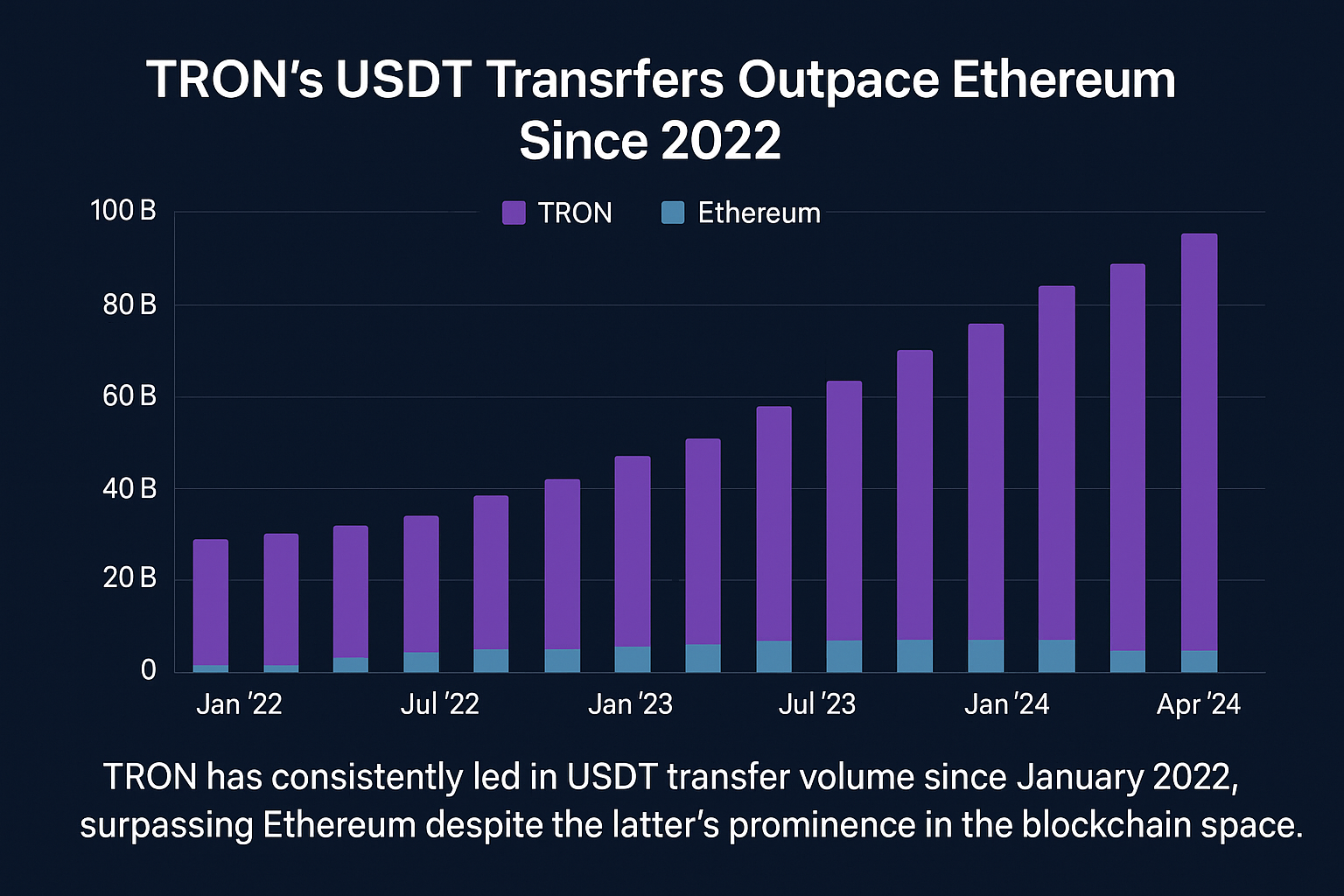

DeFi Expansion: Tackling High Gas Fees

One of the major obstacles for widespread DeFi adoption has been high transaction (gas) fees on networks like Ethereum. However, innovative solutions are beginning to emerge, helping to reduce these fees and make decentralized finance more accessible. One such solution is Ambire’s prepayment models, which allow users to pay gas fees in advance, ensuring smoother and more cost-effective transactions. These solutions are pivotal in driving DeFi adoption, as lower transaction costs make it easier for users to engage with decentralized applications (dApps) and platforms.

The Future Looks Bright for Crypto

As 2024 approaches, the combination of Bitcoin’s halving, the rise of ETFs, and the innovation in DeFi solutions sets the stage for a potentially explosive year in the cryptocurrency market. While Bitcoin remains the centerpiece of these developments, the entire market, including altcoins and DeFi projects, stands to benefit from the increased attention and capital flowing into the space.

Investors are keeping a close eye on how these factors will shape the market, with many expecting a new wave of growth and adoption in the coming year. As the cryptocurrency ecosystem continues to evolve, 2024 could be a defining year for both Bitcoin and the broader digital asset landscape.