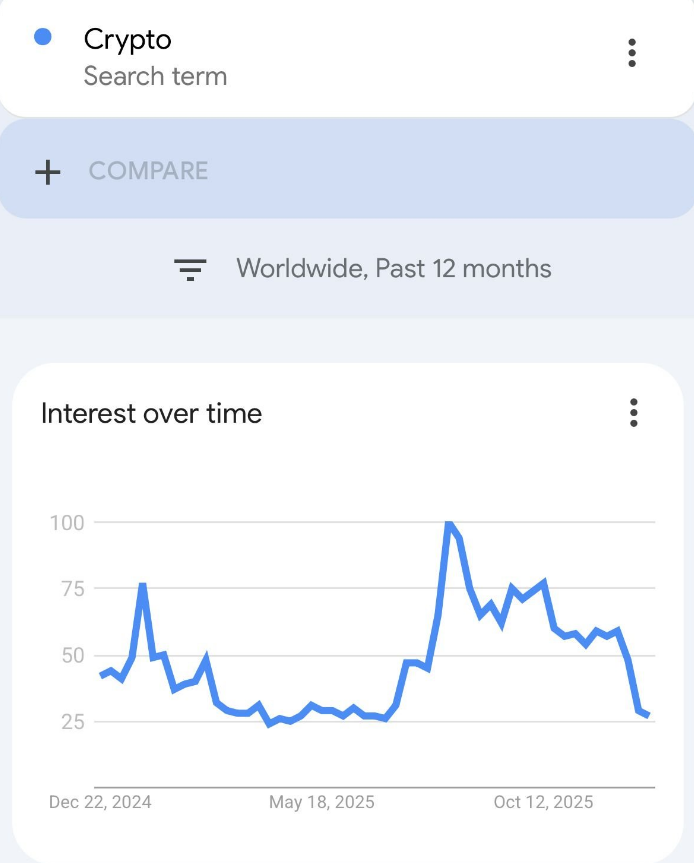

Search interest for the word “crypto” has fallen to levels not seen in a year, signaling a sharp drop in retail curiosity as 2025 ends. According to recent Google Trends readings, worldwide interest stood at 26 on the 0–100 scale, just above this year’s low of 24.

Searches Slide As Prices And Headlines Stumble

Based on reports, US search activity for “crypto” hit a one-year low of 26, underscoring that casual investors are not hunting for basic information the way they did in earlier cycles. The dip follows a turbulent year that included a severe market sell-off in April and a sharp October flash crash that knocked major coins down from recent highs.

Market watchers point to several triggers. Memecoin collapses tied to high-profile figures shook confidence. Policy shocks tied to US President Donald Trump’s tariff moves also coincided with big drops in interest during the spring. Some commentators say retail users moved on after heavy losses and viral token drama.

There is close to no retail interest in crypto right now

Do we need to start pumping the dino coins again to get retail to come back?

After the Trump/Melania memecoin drama it seems that retail lost a lot of faith in the space

None of my normie friends or family ask me… pic.twitter.com/ZNnOwT4FKe

— 0xMarioNawfal (@RoundtableSpace) December 27, 2025

Retail Pullback Could Mean Quieter Weeks Ahead

The practical effect is a quieter retail base. Trading volumes from small accounts have thinned. That does not mean prices must fall; it can mean fewer headline-grabbing rallies driven by newcomers. Institutions, which do not typically show up in Google searches, still play a big role in market flow. Year-end coverage highlights that institutional activity and regulatory moves shaped much of 2025’s action.

Analysts Offer Different Takes On What Comes Next

Some analysts warn that low retail interest removes a source of quick upside, making long rallies harder to sustain without strong macro catalysts. Others argue this lull is a pause, and that interest can return if prices break out or a major positive regulatory decision lands. Mario Nawfal and other commentators have described the current environment as a near-total absence of retail buzz.

Data Points And What They Show

The Google Trends scale gives a quick read. A 26 reading is low compared with earlier peaks during boom months. Reports from several industry outlets show the same pattern across regions, with the US particularly muted. Industry trackers note that big headline events still move markets, but everyday search traffic — the kind that often signals mass retail involvement — is down.

A fall in Google searches is a sentiment indicator, not a trading rule. It shows fewer people are asking basic questions like how to buy or where to trade. That can cut both upside and downside volatility driven by inexperienced traders.

Crypto is likely to remain under the radar until new catalysts appear, like significant price changes, regulatory updates, or a compelling story that captures mainstream interest again.

Featured image from Unsplash, chart from TradingView