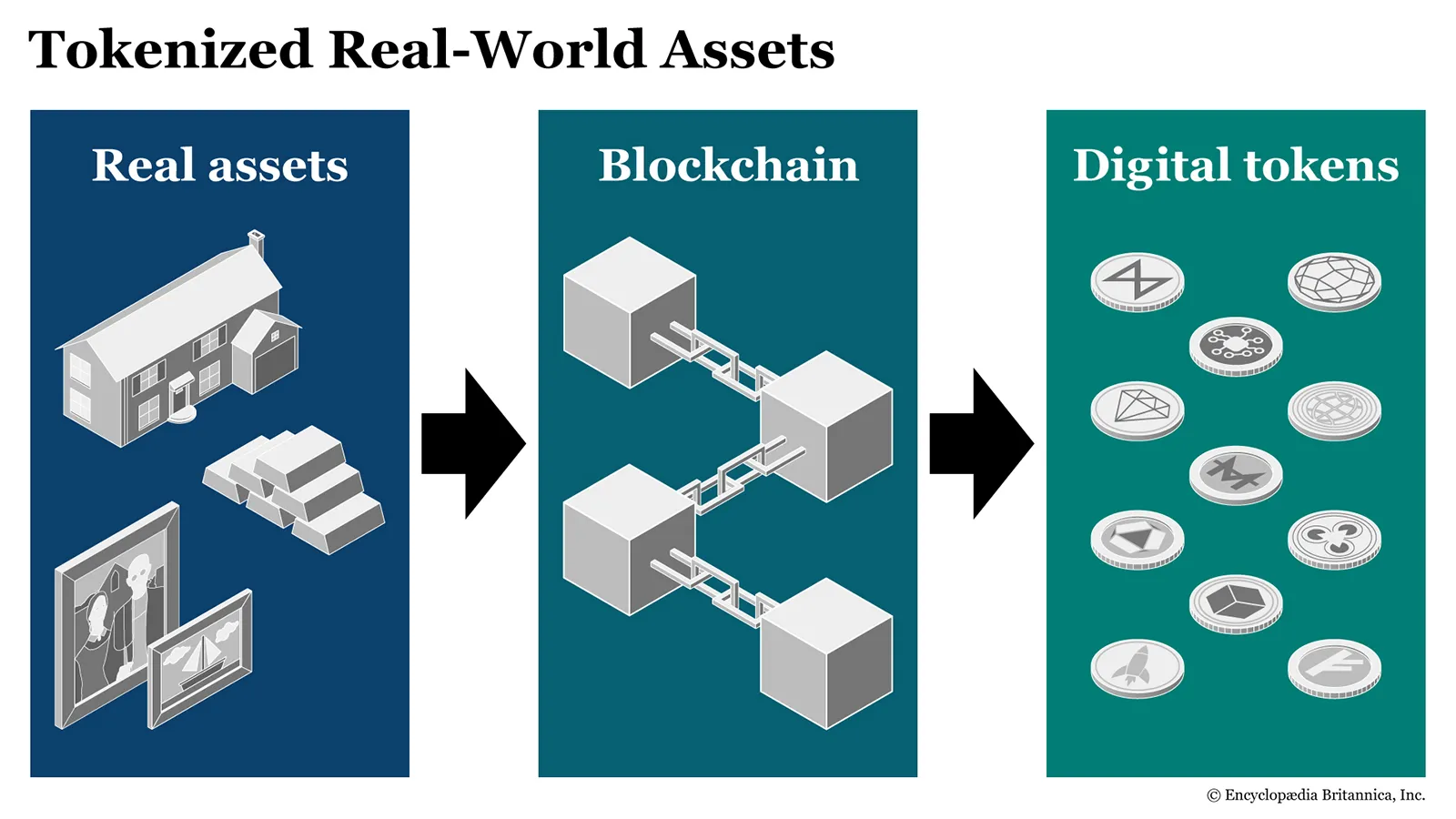

In a bold strategic move, Coinbase is expanding beyond pure cryptocurrencies into real-world asset (RWA) tokenization—bringing real assets like carbon credits and tokenized equities into the blockchain economy. This shift marks a turning point in how we think about the boundary between digital and physical assets.

Why This Matters

-

Bridging Two Worlds

Real-world assets are physical or financial assets outside the digital sphere (think real estate, commodities, securities) that can be represented as tokens on a blockchain. Coinbase+1

Coinbase’s move signals its ambition to not just facilitate crypto trades, but to become a key infrastructure player in tokenized finance. -

Carbon Credits Go On-Chain

One of the most compelling additions: tokenized carbon credits. By digitizing carbon credits, Coinbase can help solve long-standing issues in carbon markets such as double counting, lack of transparency, and inefficient trading. rwa.io+1

Coinbase currently supports MCO2, an Ethereum-based carbon token, where burning one MCO2 equals retiring one ton of CO₂ offset. Coinbase

The result? Carbon credits become more transparent, liquid, and accessible to participants of all sizes. -

Beyond Carbon: Tokenized Equities

Coinbase isn’t stopping at environmental assets. They’re exploring tokenized equities, enabling fractional ownership of traditional securities via blockchain. This opens doors for more inclusive investing and novel asset classes. -

Market Response & Momentum

The announcement has already stirred investor excitement—Coinbase’s stock rose ~4.15% following the news, reflecting optimism about its “green crypto” trajectory. Carbon Credits

The broader RWA market is also projected to explode in size; some forecasts predict it could exceed USD 10 trillion by 2030. Carbonmark

Challenges Ahead

While promising, this path isn’t without hurdles:

-

Regulation & Compliance

Tokenized securities fall under securities laws. Carbon credits may be regulated differently. Navigating jurisdictional frameworks and keeping up with evolving rules will be crucial. -

Verification & Trust

For carbon credits especially, the credibility of verification systems (i.e. the real-world emissions reductions) is critical. If the underlying projects aren’t solid, tokenization won’t fix that. Osler+1 -

Liquidity & Market Depth

Especially early on, tokenized assets may suffer from low liquidity. As Coinbase noted, they paused trading of some tokens like MCO2 due to liquidity challenges. Carbon Credits+1 -

Interoperability & Standards

Different blockchains, token standards, protocols, and identity systems need to cohere. Without compatibility, fragmentation could fragment liquidity and adoption.

What This Could Unlock

-

Democratized Access

High-value assets become divisible—small investors could own a piece of real estate, carbon project yields, or parts of equity that were once out of reach. -

Greater Efficiency & Speed

On-chain settlement, lower fees, and 24/7 markets make trading smoother and faster. -

Green Finance Meets DeFi

This convergence may drive more capital into sustainable projects, as tokenized carbon credits and ESG assets enter mainstream digital finance. -

New Business Models

From tokenized debt, arts, intellectual property, to supply chain assets—Coinbase’s expansion could catalyze new classes of tradable digital assets.