The real estate sector—once slow-moving and resistant to change—is now undergoing one of the most profound transformations in its history. At the heart of this evolution are blockchain technologies, big data analytics, and artificial intelligence (AI). These tools are not just streamlining the way properties are bought, sold, and managed—they’re completely reshaping how the industry operates.

Tokenization: Real Estate Enters the Digital Economy

One of the most revolutionary developments is real estate tokenization. Blockchain allows physical properties to be divided into digital tokens that represent shares of ownership. This not only makes investing more accessible—allowing people to buy fractions of commercial buildings or apartments—but also increases liquidity in a traditionally illiquid market.

Platforms like RealT or Propy are already facilitating property tokenization. With tokenized real estate, buyers across the globe can invest with as little as $100, and trades can occur in seconds on blockchain-based exchanges.

Title Tracking Gets a Trust Upgrade

Historically, property title verification has been slow, paper-heavy, and vulnerable to fraud. Blockchain fixes this. By using decentralized, tamper-proof ledgers, real estate titles can be tracked, verified, and transferred more securely than ever.

This has real-world momentum. In countries like Mexico and Georgia, blockchain-based land registries have already proven more efficient and trustworthy than legacy systems. A blockchain title system virtually eliminates disputes, forgeries, and corruption—an enormous benefit in emerging markets where land rights are often opaque.

Data-Driven Decisions in a Smart Market

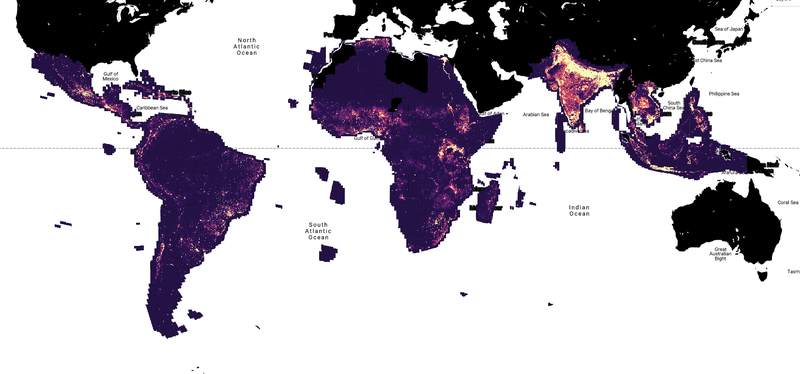

Meanwhile, big data analytics is making real estate smarter. From predicting property values to identifying the most profitable investment zones, AI-driven insights allow developers, investors, and agents to make more informed decisions.

Urban planning is also becoming more data-centric. Machine learning models can analyze foot traffic, population growth, zoning laws, environmental risks, and economic indicators to recommend optimal land use and development strategies. This reduces risk, cuts costs, and accelerates time-to-market.

Automation at Every Step

Smart contracts—self-executing agreements written in code—are automating the real estate transaction process. From escrow to final settlement, many middlemen (and their fees) are becoming obsolete. Buyers and sellers can now engage in trustless transactions, where deals close instantly once conditions are met.

These efficiencies aren’t limited to residential sales. Commercial real estate, leasing, and facility management are also leveraging blockchain-backed systems to streamline operations and reduce administrative overhead.

ESG and Transparency

As investors increasingly demand Environmental, Social, and Governance (ESG) accountability, blockchain and big data play a key role. Energy usage data, emissions, tenant demographics, and building sustainability metrics can be monitored and shared in real-time. This level of transparency enables responsible investment and regulatory compliance.

We’re only scratching the surface of what’s possible. As AI and data pipelines grow more powerful and blockchain adoption deepens, the real estate industry could become almost fully digital—accessible 24/7, globally liquid, and verifiably transparent.

This transformation isn’t just about innovation—it’s about democratization, efficiency, and trust. Whether you’re an investor, buyer, developer, or policymaker, the convergence of blockchain, AI, and big data is not a trend—it’s the new foundation of real estate.