Bitcoin, the pioneer of cryptocurrencies, continues to capture the attention of investors and analysts as its price rises steadily. Recently, Bitcoin’s value climbed by 1.8%, reaching $99,449. This upward momentum has reignited discussions about its potential to break new records, with Wall Street analysts predicting that surpassing the $97,000 resistance level could pave the way for Bitcoin to surge above $110,000.

The Significance of $97,000

Breaking key resistance levels often serves as a psychological and technical milestone for assets, and Bitcoin is no exception. The $97,000 mark has been identified as a critical threshold by market experts. This level not only represents a psychological barrier for many traders but also serves as a key technical point that could unleash significant buying pressure.

Historically, when Bitcoin breaks through such resistance levels, it triggers a wave of market activity, driven by a combination of retail and institutional investors seeking to capitalize on the bullish trend. Analysts believe this pattern could repeat, potentially driving Bitcoin to new highs in the coming months.

Factors Driving Bitcoin’s Surge

Several factors contribute to Bitcoin’s recent price ascent:

- Institutional Interest: Major Wall Street firms and institutional investors continue to show interest in Bitcoin, with many viewing it as a hedge against inflation and a store of value akin to digital gold.

- Bitcoin ETFs: The increasing adoption and approval of Bitcoin exchange-traded funds (ETFs) have provided easier access to the cryptocurrency market for traditional investors, fueling demand and liquidity.

- Macroeconomic Environment: With global economic uncertainty and central banks maintaining dovish monetary policies, Bitcoin is becoming an attractive alternative for wealth preservation.

- Scarcity and Halving Cycle: Bitcoin’s fixed supply of 21 million coins and its halving cycle, which reduces the mining reward every four years, continue to play a crucial role in its long-term value appreciation.

Wall Street’s Optimistic Outlook

Wall Street analysts are increasingly optimistic about Bitcoin’s trajectory. Many believe that breaking the $97,000 resistance will act as a catalyst, propelling the asset to test the $110,000 level and beyond. This confidence stems from both technical analysis and the broader adoption of cryptocurrencies in mainstream finance.

Key Predictions:

- Some analysts forecast Bitcoin could reach $120,000 within the next year, assuming macroeconomic conditions remain favorable.

- Institutions that were previously cautious about cryptocurrency investments are now actively exploring opportunities, adding further legitimacy to the market.

Risks and Challenges

Despite the bullish sentiment, potential risks could impact Bitcoin’s ascent:

- Regulatory Concerns: Governments worldwide continue to grapple with how to regulate cryptocurrencies, and any adverse regulatory developments could weigh on prices.

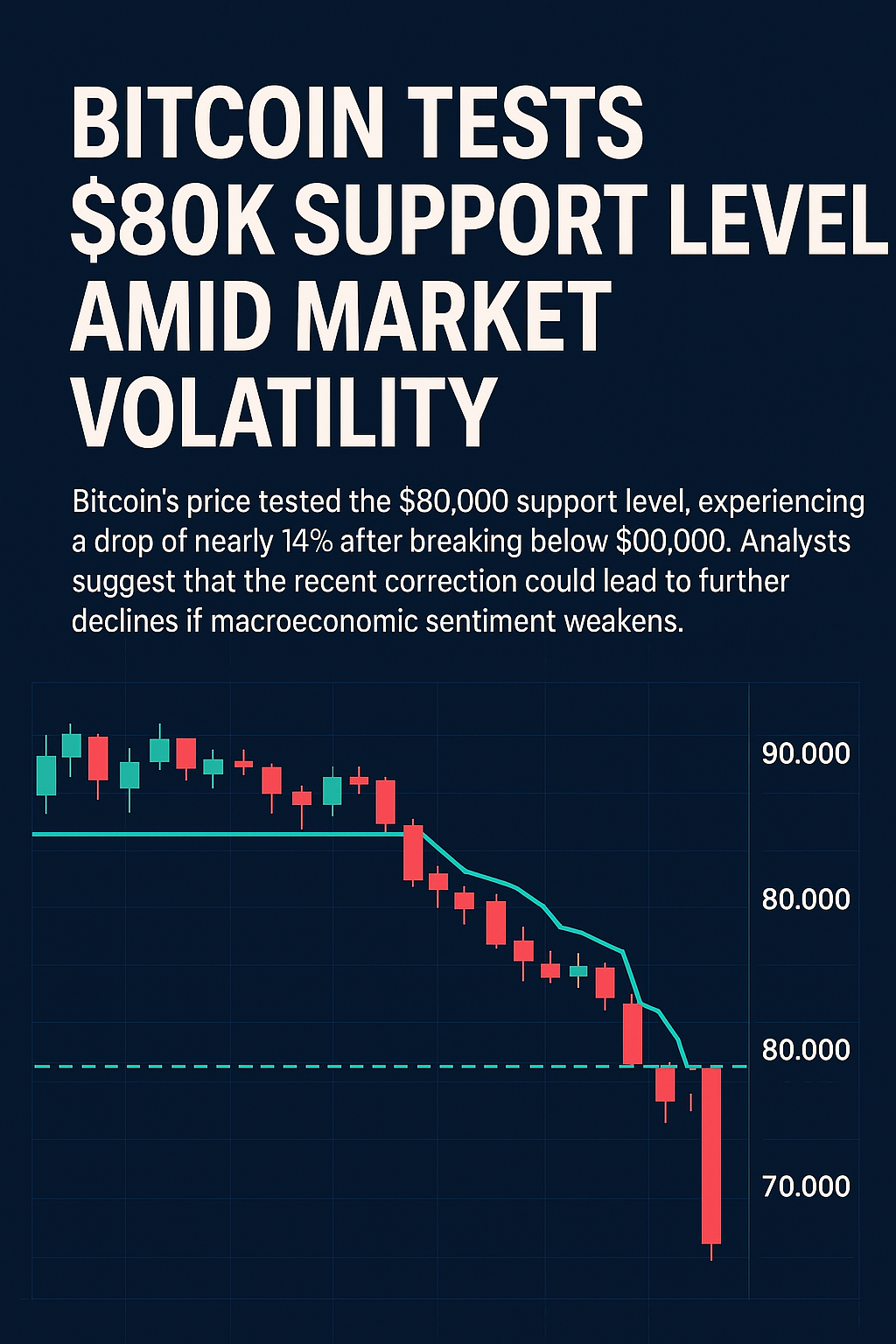

- Market Volatility: Bitcoin is known for its price volatility, which can deter risk-averse investors.

- Competition: The rise of altcoins and competing blockchain technologies could divert attention and capital away from Bitcoin.

The Road Ahead

As Bitcoin flirts with the $100,000 milestone, the excitement and anticipation within the market are palpable. Whether it can sustain this momentum and reach new highs above $110,000 remains to be seen, but one thing is certain: Bitcoin’s journey continues to redefine the financial landscape.

For investors, the current trend presents both opportunities and challenges. As always, understanding market dynamics and maintaining a diversified portfolio will be key to navigating the volatile yet promising world of cryptocurrencies.