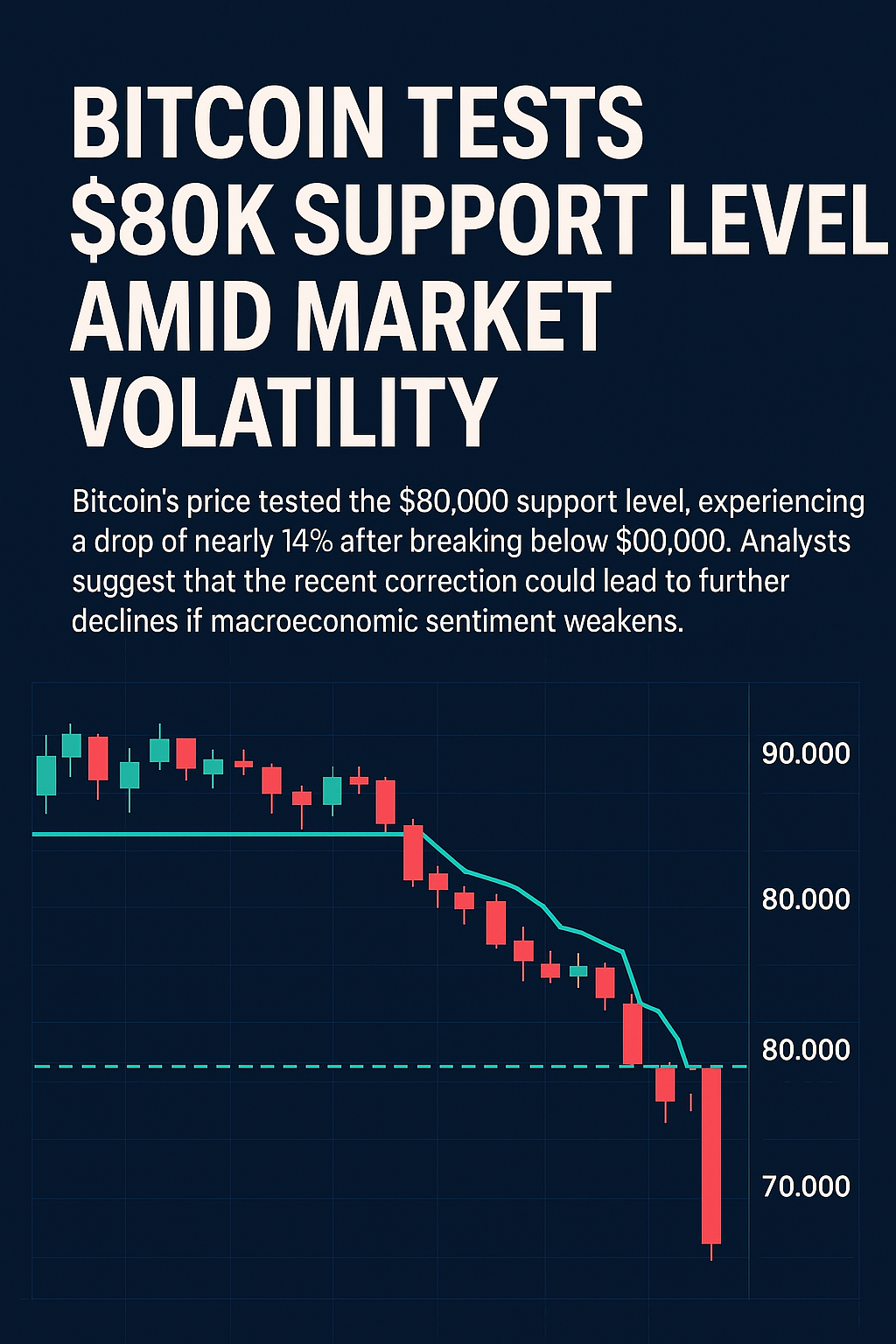

The cryptocurrency market witnessed a sharp correction on March 4, 2025, as Bitcoin’s price fell below the crucial $90,000 level, briefly testing support at $80,000. The nearly 14% drop caught traders off guard and raised concerns about the strength of the ongoing bull run.

After reaching a high of over $109,000 in January 2025, Bitcoin had been consolidating in a wide range. However, a combination of macroeconomic concerns, including fresh U.S. tariffs and rising interest rate fears, triggered a wave of sell-offs across risk assets — with crypto feeling the impact most heavily.

Technical analysts are closely watching the $80,000 level, which has historically served as a key psychological and structural support. A confirmed break below this could open the door to further downside, potentially retesting the $70,000 range, especially if global investor sentiment continues to deteriorate.

On-chain data also reflects increased movement of long-term holders to exchanges, which often precedes major selling events. Meanwhile, altcoins such as Ethereum and Solana experienced even steeper drops, signaling a broad market retracement rather than isolated weakness in BTC alone.

Still, some analysts see this as a healthy correction in an otherwise strong uptrend. “Every bull cycle has its pullbacks. The key is whether buyers step in at $80K or wait for deeper discounts,” commented a strategist at a leading crypto research firm.

For now, all eyes remain on the macro landscape. If economic uncertainty persists, Bitcoin’s next move could be shaped more by global headlines than technical charts.

Source: Cointribune – March 4, 2025