As an aftermath of the October 10 market crash, where Bitcoin’s price reached levels as low as $101,500, the market is exhibiting a recognizable bearish on-chain structure. While the selling momentum seems to be slowing down, giving a sliver of hope to potential market participants, recent on-chain analysis seems to point towards caution as the more correct sentiment to have in the short term.

Realized Profits Climb As High As $2.25 Billion

In an October 11 post on social media platform X, technical and on-chain analyst Darkfost revealed that a lot of Bitcoin investors might still be taking profits from their last buys.

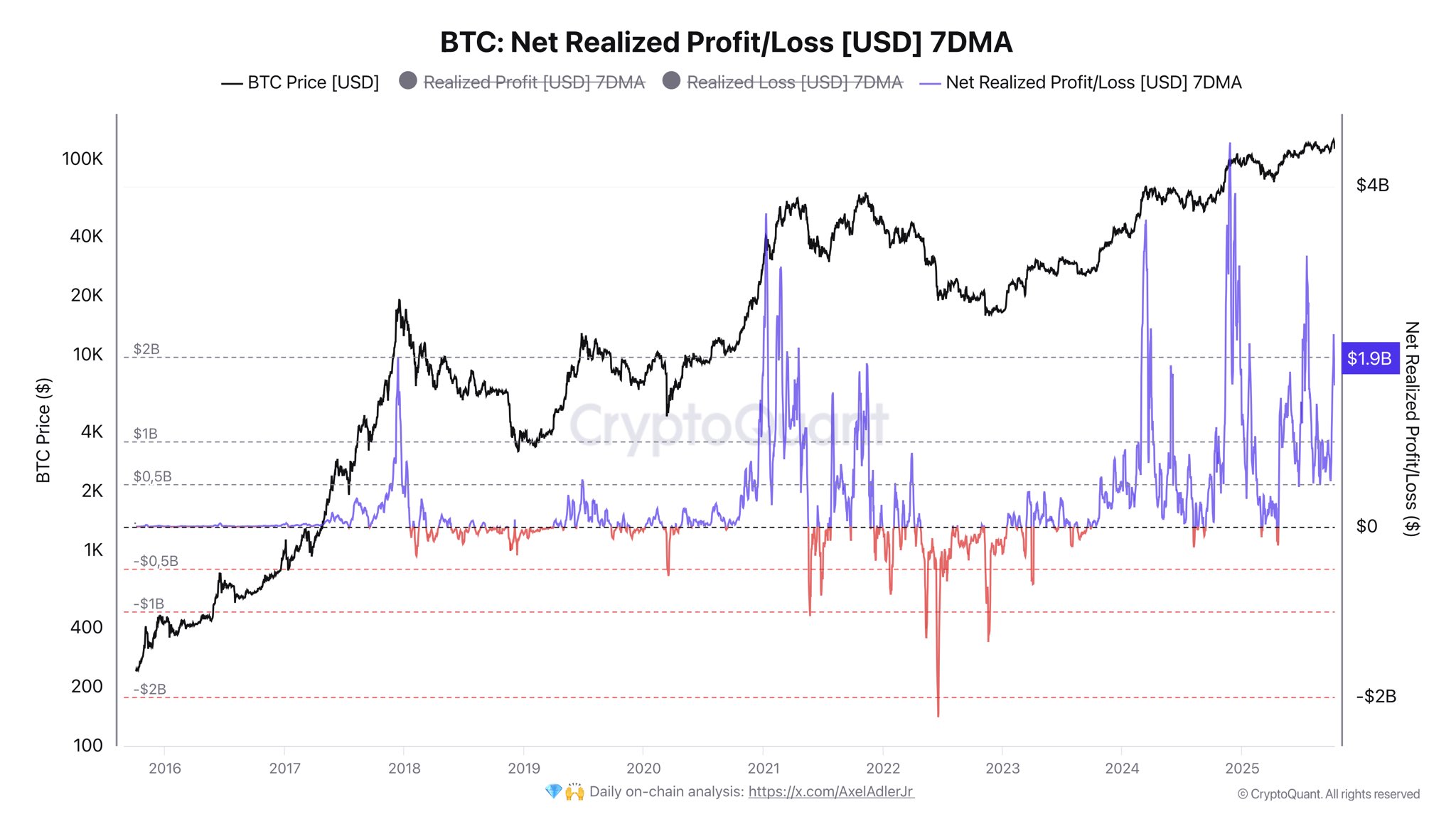

In the post on X, Darkfost cited results obtained from the Net Realized Profit/Loss [USD] 7 Day MA indicator. This metric keeps tabs on the average daily difference between the total amount of realized profits and losses of transactions over the past seven days.

For context, realized profits refer to the total amount in USD of Bitcoin sold at prices higher than the levels of purchase, showing that investors are selling in the green. On the other hand, realized losses reflect the total Dollar worth of Bitcoin sold below their cost of purchase.

The analyst put it out that the 7-day moving average of the Net Realized Profit/Loss metric recently reached a peak of $2.25 billion, the fourth-highest level seen in the current market cycle. Meanwhile, the metric’s weekly average holds well above $1.6 billion, indicating that profit-taking is still at a high level.

Darkfost noted that if the Bitcoin market continues to witness this magnitude of profit-taking, it might be a while before the premier cryptocurrency switches from its current bearish sentiment to a more optimistic one.

$99,000-$104,000 May Be The Next Price Support

In another post on X, cryptocurrency pundit Ted Pillows pointed out the $99,000-$104,000 region as the next possible support if the Bitcoin price were to keep sliding.

According to the analyst’s post on X, this price range has a decent amount of spot bids sitting within it, enough to act as a support zone to keep the Bitcoin price afloat.

The next market trajectory thus seems to depend on whether investor profit-taking would remain high. In the scenario where it does, the $99,000-$104,000 price range might be the next zone to keep an eye out for.

In an upside scenario, Pillows explained that the $119,000 price level and other zones above hold most of the sell orders currently in the market.

As of this writing, Bitcoin is worth approximately $111,772, reflecting an over 1% gain in the past 24 hours.