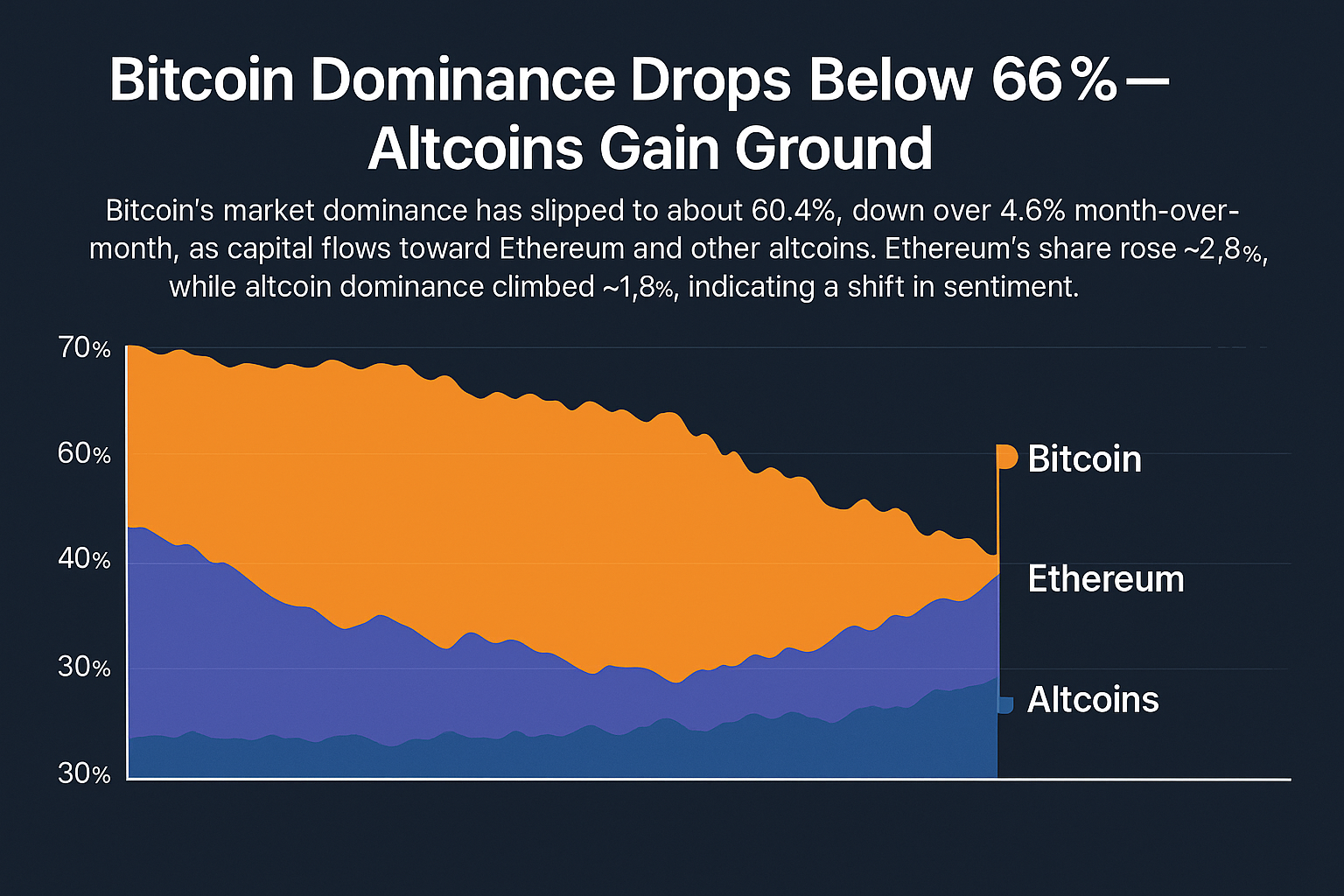

For over a decade, Bitcoin has stood as the unrivaled titan of the crypto world—resilient, dominant, and largely unchallenged in its market share. But July 2025 has delivered a subtle yet significant shift in that narrative. According to recent data, Bitcoin’s market dominance has fallen to 60.4%, down more than 4.6% from the previous month, marking one of the steepest monthly drops in the past year.

Meanwhile, the tides are turning in favor of the broader altcoin market. Ethereum’s dominance has surged by approximately 2.8%, riding on bullish sentiment driven by Layer-2 scaling advancements, real-world asset (RWA) tokenization, and renewed interest in decentralized applications (dApps). The rest of the altcoin market has also seen a combined 1.8% increase in dominance, suggesting a more distributed inflow of capital across a diversified ecosystem of tokens.

What’s Driving the Shift?

Several factors may be contributing to this redirection of capital:

-

Ethereum’s Ecosystem Momentum: With the successful implementation of EIP-7880, which streamlined data availability and slashed gas fees, Ethereum has regained developer attention and user activity. ETH is not just an asset—it’s infrastructure.

-

RWA Tokenization Boom: From tokenized real estate to ESG-backed bonds, many of the new high-profile tokenization efforts are building on Ethereum or Ethereum-compatible chains like Base and Optimism.

-

AI & Altcoin Synergies: Altcoins such as Render, Fetch.ai, and Ocean Protocol are seeing capital inflows as investors bet on the intersection of artificial intelligence and blockchain.

-

Bitcoin’s Relative Stagnation: Despite holding strong above $110K, Bitcoin has entered a period of sideways consolidation. Traders seeking higher short-term yields are reallocating capital toward faster-moving altcoins.

Is This the Beginning of a New Altcoin Season?

The decline in Bitcoin dominance is often interpreted as a potential precursor to an “altcoin season,” a period when non-Bitcoin assets significantly outperform BTC. Historically, such seasons have followed major Bitcoin rallies or periods of consolidation, which matches the current landscape.

However, it’s worth noting that altcoin rallies are often more volatile and fragmented. The gains are not evenly distributed, and investor discretion is key. Projects with strong fundamentals, real-world use cases, or ties to emerging narratives like AI, ESG, and DePIN (decentralized physical infrastructure networks) are more likely to sustain momentum.

The Broader Implication: A Maturing Market?

This ongoing shift may also reflect the maturation of the crypto market. Investors are increasingly evaluating digital assets based on sector exposure, token utility, and network activity—rather than just the Bitcoin vs. fiat binary. A drop in BTC dominance doesn’t necessarily imply weakness, but rather a broader diversification of conviction across the ecosystem.

As the lines between DeFi, AI, real-world assets, and NFTs continue to blur, a more nuanced and balanced allocation strategy may become the norm, replacing the BTC-maximalist approach of years past.