Bitcoin is subject to the pressure of renewable sale days after uniformity just less than its highest level ever. The market, which was shook, due to the total economic uncertainty and increasing fluctuations, forced BTC to the cooling stage around the range of 103 thousand dollars to 106 thousand dollars. While the bulls still control the broader direction, the current withdrawal reflects the increasing caution among investors amid global financial opposite winds.

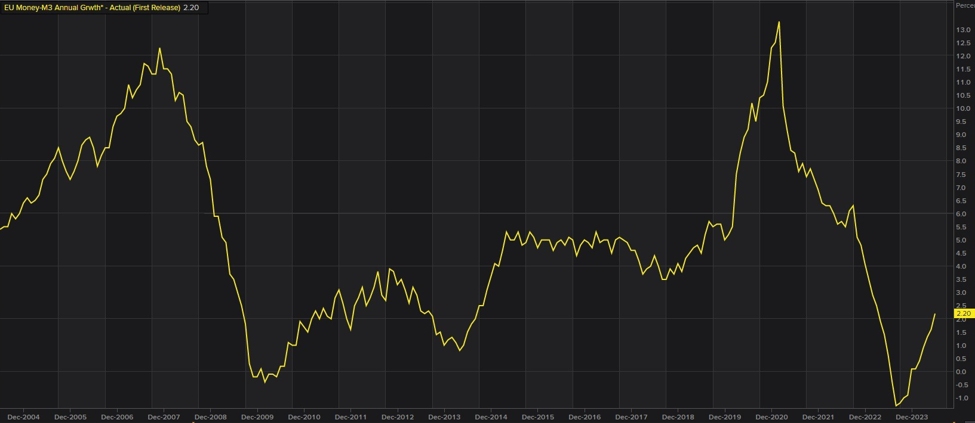

One of the main factors that make up the morale is the high American cabinet revenue, which still indicates the physical stress and more strict liquidity. These conditions have historically created a mixed environment for risk origins such as Bitcoin and Altcoins, and often lead to temporary corrections before moving the next motivation.

TED Bidows participated in a convincing taking, indicating that Bitcoin’s dominance may have already reached its peak in this course. If this is true, this may represent the beginning of the rotation of the capital to altcoins – a sign that altseason may be just around the corner. With ethereum and other higher assets that maintain major levels, the market can enter a transitional stage. BTC may settle in the short term, but all eyes are now on whether altcoins begins to excel and transform momentum through the broader encryption space.

Bitcoin dominance in the midst of global tensions

Bitcoin faces a critical moment after recovering more than 7 % of its highest level ever at $ 112,000. Since the price is to unify the range between 103,000 – 105,000 dollars, merchants and analysts closely monitor to see if this is a healthy decline or a broader turning in the market structure. This decline comes amid the growing macroeconomic tensions, as it presented the confrontation of the continuous tariff in the United States – China is a new wave of uncertainty that global markets tear.

Despite the short -term weakness, Bitcoin was the undisputed leader for this session. Since its outbreak in 2021, BTC has constantly outperformed the broader encryption market, indicating flexibility in the face of economic fluctuations and regular financial risks. Altcoins, on the other hand, struggled to restore its highest levels in 2021, with a large number of previous summits.

However, not everyone thinks that bitcoin will continue to control. The pillows recently suggested BTC’s dominance is likely to be peak on this course. While it warns that “nothing in a straight line”, the dominance of the BTC fall is historically one of the strongest signs of the beginning of Altseass. If this trend continues, it may be a turning point for Altcoins to restore the market share and excel in the coming months.

However, the transition will not be immediate. Hegemony trends can take some time to develop, and Bitcoin price procedures remain the main driver of the general market direction. Currently, Bitcoin tests the support, the broader market holds its breath, and closely monitors the signs of a new stage in this bull cycle.

BTC Prices Analysis: approaching Make -or-Break’s support

Bitcoin is currently trading at 103,764 dollars, hovering above the main support level at $ 103,600. The graph for 4 hours shows a clear declining momentum after BTC failed to penetrate its highest level over $ 112,000 last week. Since then, the price has decreased steadily, with its highest levels decreased and its lowest levels decreased with a short -term declining structure.

BTC is now testing horizontal support at $ 103,600 and average simple simple movement 200 (SMA), which currently determines about 102,600 dollars. This region is very important to defense. The continuous interruption below can open the door to deep recovery operations, and perhaps towards the psychological level of $ 100,000 or even a 98 thousand dollar region to 99 thousand dollars.

On the other hand, holding this support may lead to a recovery. The short -term moving averages (34 EMA and 50 SMA) began to circumvent, indicating pressure residue, but the excessive sale conditions may attract buyers in the event of a decline in size.

Currently, the biotoin bullish structure is sound in the upper timelines, but the short -term trend depends on the defense of this demand area. The next sessions will be very important in determining whether BTC settles for another leg or collapses to search for less support.

Distinctive image from Dall-E, the tradingView graph

Editing process For Bitcoinist, it is focused on providing accurate, accurate and non -biased content. We support strict resource standards, and each page is subject to a diligent review by our team of senior technology experts and experienced editors. This process guarantees the integrity of our content, importance and value of our readers.

The post Bitcoin Dominance May Have Hit Its Cycle High – What Comes Next For Alts? first appeared on Investorempires.com.