The cryptocurrency market remains one of the most dynamic and volatile financial ecosystems. Price movements can be influenced by macroeconomic trends, regulatory developments, and shifts in investor sentiment. Recent discussions have highlighted the importance of data-driven decision-making to help traders manage risks and seize opportunities in an uncertain market.

With Bitcoin nearing record highs and altcoins showing mixed performance, market participants are closely analyzing on-chain metrics, liquidity trends, and institutional activity to anticipate potential shifts. This article explores recent cryptocurrency market trends, the factors driving them, and why traders must rely on verified data rather than speculation.

Volatility Remains a Defining Feature

Cryptocurrencies are known for their rapid price swings, often driven by external factors such as:

- Macroeconomic Conditions: Inflation reports, Federal Reserve rate decisions, and economic outlooks impact crypto prices. Recent CPI data has led to fluctuating expectations about future interest rate cuts, directly influencing Bitcoin and Ethereum.

- Regulatory Developments: Governments worldwide are advancing their approaches to crypto regulation. The approval of Bitcoin ETFs in major markets has driven institutional interest, while ongoing discussions about stablecoin frameworks and taxation policies create uncertainty.

- Liquidity and Trading Volume: Periods of low liquidity can amplify price fluctuations. Over the past month, liquidity metrics suggest institutional investors are accumulating Bitcoin, while some altcoins have faced selling pressure.

With these factors in play, traders are advised to analyze real-time data and verified sources rather than react emotionally to headlines.

Bitcoin’s Performance and Market Sentiment

Bitcoin has continued to dominate market discussions, with its price fluctuating near key resistance levels. Analysts suggest that BTC’s ability to hold above $90,000 could determine the next leg of its rally.

Key Trends in Bitcoin’s Price Action:

- On-Chain Data: Large wallet holders (whales) are actively accumulating BTC, suggesting long-term confidence.

- ETF Inflows: The introduction of Bitcoin ETFs has provided new capital inflows, further supporting the market.

- Correlation with Gold: Bitcoin’s correlation with gold has strengthened, reinforcing its position as a hedge against economic uncertainty.

While Bitcoin remains strong, altcoins have experienced mixed trends, with some gaining momentum and others struggling to attract new capital.

Altcoin Market Trends and Sector Performance

The altcoin market has been volatile, with some projects gaining traction based on new developments, partnerships, or technological upgrades.

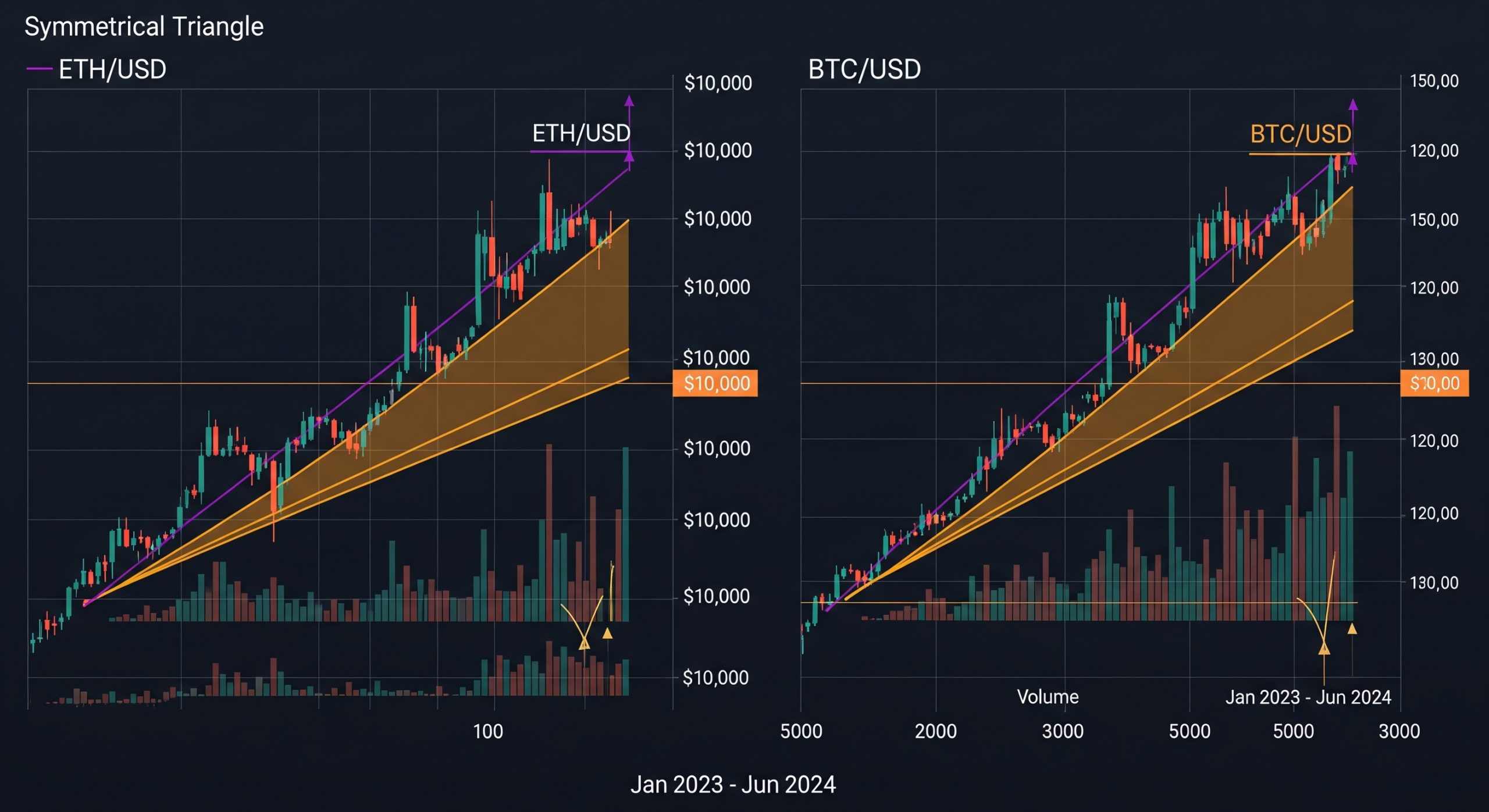

- Ethereum (ETH) is facing key resistance at $3,000, with analysts watching for signs of a breakout. Its network upgrades and staking activity remain central to investor sentiment.

- Solana (SOL) has maintained its momentum, benefiting from increased adoption in DeFi and NFT markets.

- Layer 2 Solutions (Arbitrum, Optimism) continue to see strong user adoption, with increased transaction volumes indicating real-world use cases.

However, traders should exercise caution when speculating on smaller-cap assets, as liquidity and volatility remain high.

The Importance of Data-Driven Trading

Given the unpredictable nature of the crypto market, relying on verified data sources is more important than ever. Traders and investors can benefit from tools such as:

- On-Chain Analytics: Platforms like Glassnode and CryptoQuant provide insights into market liquidity, whale movements, and exchange flows.

- Technical Indicators: Support and resistance levels, RSI, and moving averages help traders identify potential entry and exit points.

- Macro and Regulatory Trends: Keeping an eye on government policies, global economic data, and institutional movements is crucial for long-term positioning.

Emotional trading and reacting to unverified news or social media hype can lead to losses. Staying informed through reputable sources ensures better decision-making in a volatile market.

As the cryptocurrency market continues to evolve, traders must remain disciplined and informed. Bitcoin’s performance, macroeconomic conditions, and regulatory decisions will play key roles in shaping future price action. By relying on data-backed analysis, investors can navigate market trends effectively and minimize risk in an ever-changing environment.

Will Bitcoin sustain its momentum? How will altcoins react to shifting liquidity patterns? The next few months will be crucial in defining the broader market trajectory.