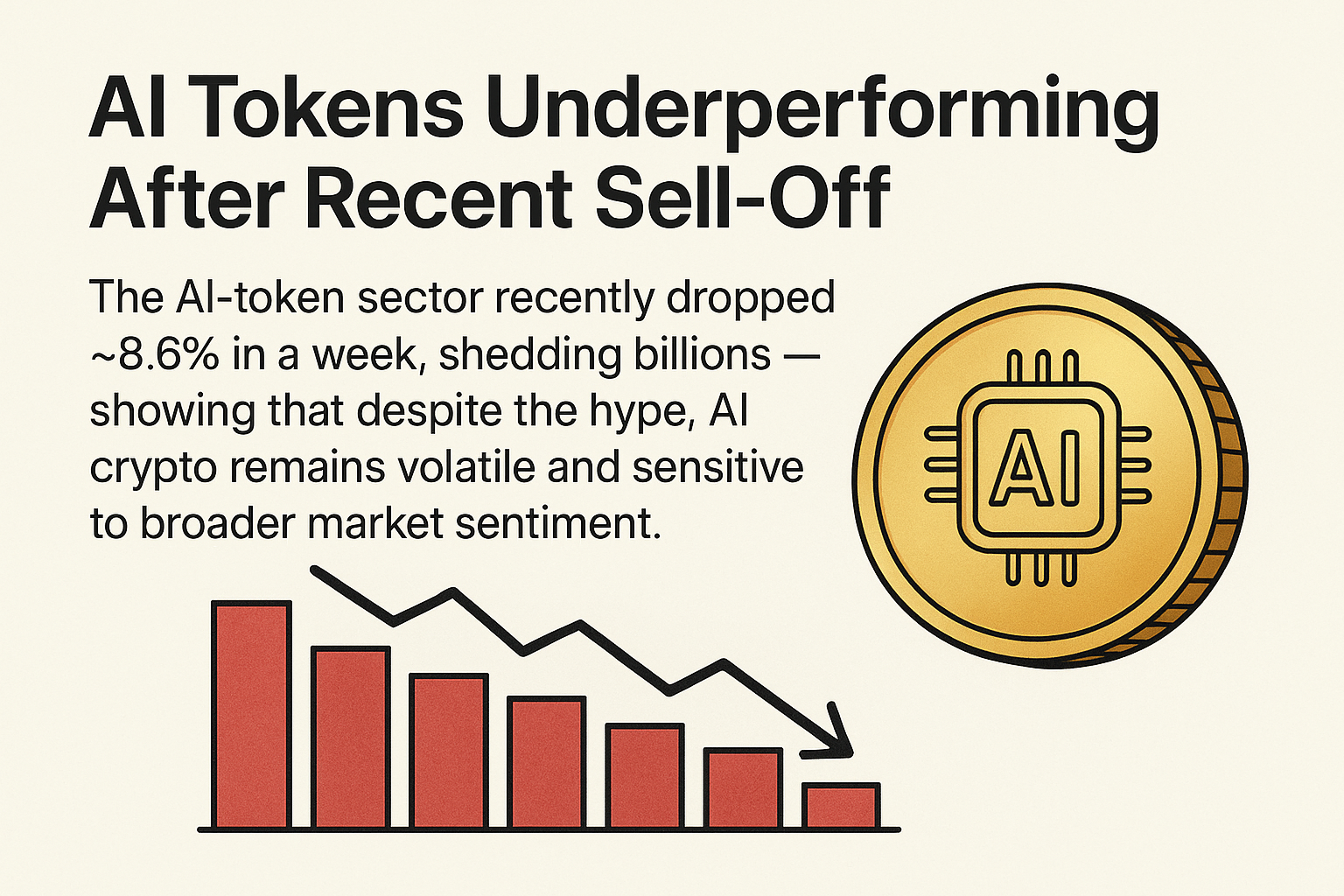

The artificial intelligence (AI) narrative has been one of the strongest drivers in the crypto market over the past year. From decentralized compute networks to data marketplaces and AI agent tokens, investors poured billions into projects promising to merge machine intelligence with blockchain infrastructure. However, the recent sell-off has been a sharp reminder that hype alone does not make any sector immune to market cycles.

Over the past week, the AI-token sector dropped by approximately 8.6%, wiping out billions of dollars in market capitalization. This decline came despite continued headlines about AI adoption in traditional tech and growing enterprise interest. The contrast highlights a critical truth: AI crypto tokens remain highly sensitive to broader market sentiment, liquidity conditions, and short-term risk appetite.

Why Did AI Tokens Fall So Hard?

The recent downturn was not driven by a single event, but rather a combination of macro and sector-specific factors:

First, the broader crypto market experienced a risk-off phase. When Bitcoin and Ethereum show weakness or move sideways with declining volume, smaller narrative-driven sectors tend to suffer disproportionately. AI tokens, many of which have lower liquidity and higher speculative exposure, were quick to feel the pressure.

Second, profit-taking played a major role. AI tokens were among the best-performing assets earlier this year, attracting short-term traders. Once momentum slowed, these traders exited rapidly, accelerating the sell-off and triggering stop-loss cascades across multiple exchanges.

Finally, expectations may have run ahead of reality. While AI technology is advancing rapidly, many blockchain-based AI projects are still early-stage. Revenue models, real adoption, and sustainable token economics often lag behind valuations, making prices vulnerable when sentiment shifts.

Hype vs. Fundamentals

The correction does not mean that AI crypto is “dead.” Instead, it exposes the gap between narrative-driven speculation and fundamental progress. Strong projects in this space continue to build infrastructure for decentralized compute, data sharing, and AI-driven automation. However, the market is becoming more selective.

Investors are increasingly asking harder questions:

- Does the protocol have real users?

- Is there on-chain activity beyond incentives?

- Does the token have a clear role in the ecosystem?

Projects that cannot answer these questions convincingly are likely to continue underperforming, especially in uncertain market conditions.

What This Means for Investors

For long-term believers, periods like this can serve as a reality check rather than a death sentence. Volatility is not a flaw unique to AI tokens — it is a feature of crypto markets as a whole. However, AI tokens amplify this volatility because they sit at the intersection of two fast-moving, hype-driven industries.

Short-term traders should expect continued sharp moves in both directions, closely tied to overall market momentum. Long-term investors, on the other hand, may view the pullback as an opportunity to reassess portfolios, rotate into higher-quality projects, or simply wait for clearer confirmation of trend reversal.

Looking Ahead

The AI-token sector remains one of the most compelling long-term narratives in crypto, but the recent sell-off underscores an important lesson: innovation does not eliminate risk. As liquidity tightens and sentiment fluctuates, only projects with real utility, transparent roadmaps, and sustainable economics are likely to outperform over time.

In the coming months, the key drivers to watch will be broader market direction, Bitcoin dominance, and tangible adoption metrics within AI-focused blockchain projects. Until then, volatility is likely to remain the norm rather than the exception.