Listen and subscribe to opening the offer on Apple podcastand Spotifyand Amazon musicand YouTube Or wherever you find your favorite podcast.

After spending the week in chatting with global and economic investors and world leaders in the annual Spring Spring meetings of the International Monetary Fund (IMF) in the capital, Rebecca Patterson, the former chief investment employee in Bridge, is interested in the market that the market may excel after the first Trump defeat in April.

“The biggest (ready -made meals) for me was a reading of the non -American investor, and the global investor now. I am talking about big institutional investors, people who run large pension funds, sovereign wealth boxes, and they rethink in the United States,” Patterson told me in an attempt to open Yahoo Finance (watch above).

Patterson is an older colleague in the Council of Foreign Relations. She is also an independent director of Vanguard, the director of global assets with more than $ 10 trillion in management assets. Previously it was the largest investment strategies in Bridgewateer Associas, the world’s largest hedge box.

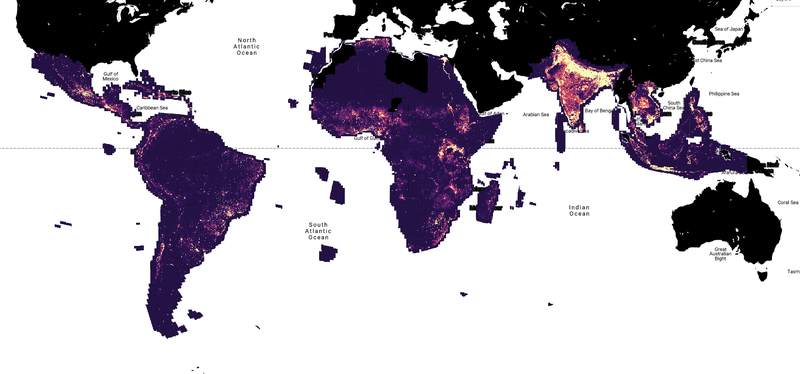

“I think there is a new risk bonus on American assets, as foreign investors who were not present before the liberation day, perhaps before the administration begins … the Treasury estimates that we have about $ 30 trillion of American stocks and bonds by foreign investors,” Patterson said.

For example, if the Canadian pension box decides to reduce the customization of American stocks and bonds by 2 % for each of them – a total of 4 % – it is a small adjustment of the box. But if all foreign investors do so, “$ 1.2 trillion will leave us our assets,” Patterson explained.

Her caution is inconsistent with what investors have witnessed since mid -April, as the Trump administration has shown a willingness to talk about customs tariff deals.

Read more: Latest news and updates on Trump’s tariff

S&P 500 (^Gspc) has seen a four -day gathering despite a series of mixed profit reports such as family names such as Pepsico (Peps). Bad companies have been received from companies such as Tesla (TSLA) properly, as these shares have increased by 25 % in the past five trading sessions.

The measurement index increased by 12 % of its basin, April 8 (but still decreased by 10 % from the mid -February summit).

The Japanese Topix index closed on Monday at 2650.61, higher than the closure on April 2, before Trump revealed the tariff scheme.

Calm the safe gold trade that dominated 2025 touches.

The number of temporary calories are multiple on S&P 500 now 19.9 times, and it is removed away from the assessments seen during the recession periods, according to Peter Peresin’s data, chief strategic expert at BCA Research.

However, Patterson is not alone in questioning the assembly as foreign investors ask about the fluctuations of American policy.

“The uncertainty that led to the policy of the customs tariffs of the administration, especially with multiple repercussions, as well as the annoying questions that may be undermined the independence of the Federal Reserve, has raised concerns in the foreign investor community that was largely overweight in American assets.”

“It is difficult to re -genie to the bottle by just raising these concerns. Therefore, the allocations for foreign investors to American investments may reduce and turn into non -American assets, especially when allocating the new capital, while the hedge rates are their currency to exposure to American assets may increase, and both may continue to pressure the US dollar.”

Read more: What does Trump’s tariff mean for the economy and your wallet?

Three times every week, Yahoo Males Editor Brian Suzy Talks and conversations full of insight with the largest names in business and markets Opening offer. You can find more episodes on Video center Or witness to Favorite broadcast service.

Brian Suzy It is the executive of Yahoo Finance. Follow Sozzi on X briansozziand Instagram On LinkedIn. Tips about stories? Send an email to Brian.sozzi@yahoofinance.com.

Click here for an in -depth analysis of the latest stock news and events that move stock prices

Read the latest financial and commercial news from Yahoo Financing

The post A slight sell-off by foreign investors could rock the US stock market, says veteran CIO first appeared on Investorempires.com.